Insights and news from the ATOM Mobility team

We started our blog to share free valuable information about the mobility industry: inspirational stories, financial analysis, marketing ideas, practical tips, new feature announcements and more.

We started our blog to share free valuable information about the mobility industry: inspirational stories, financial analysis, marketing ideas, practical tips, new feature announcements and more.

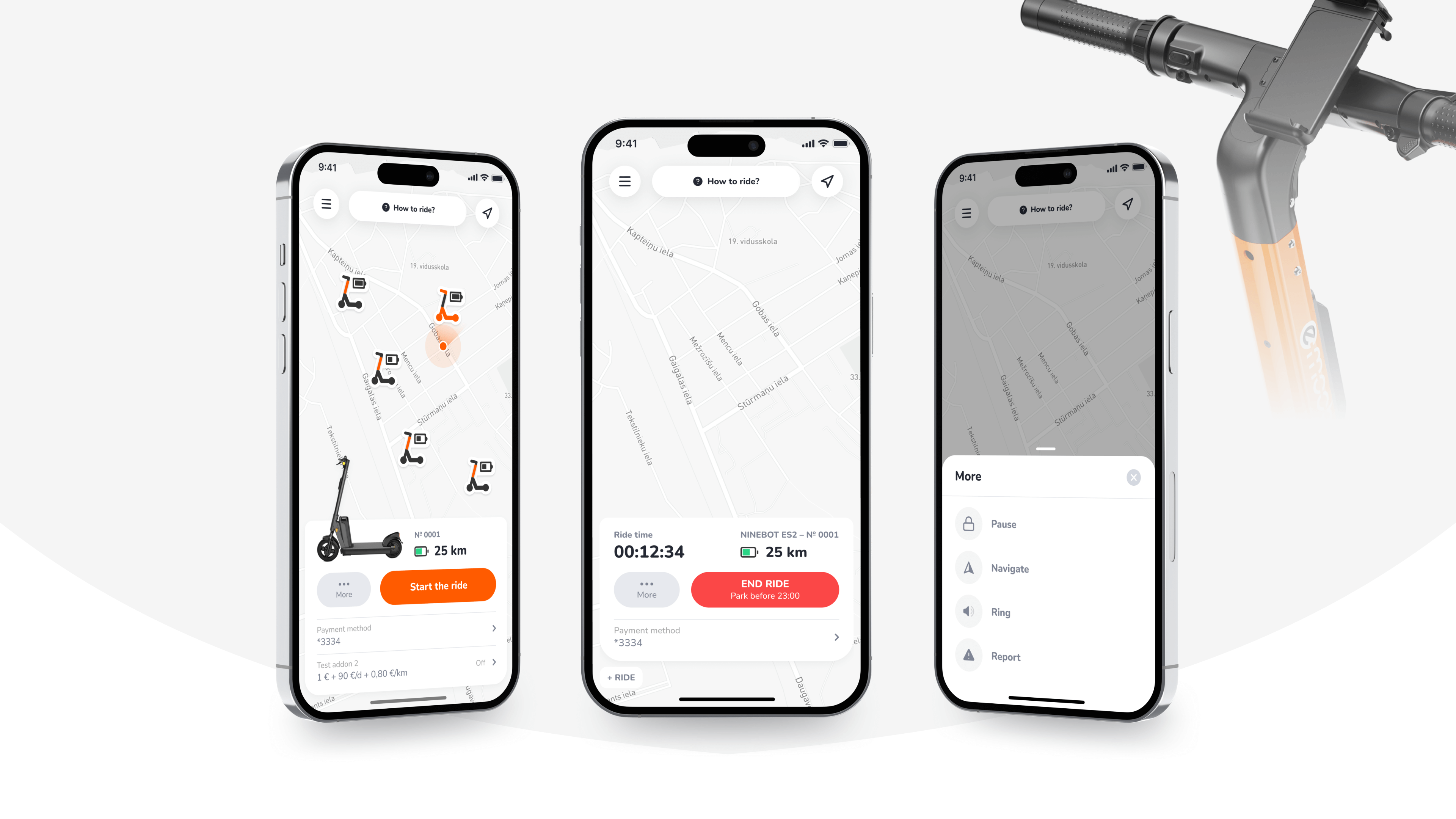

🚗📲 Whether you're renting out cars, bikes or scooters, the best rental businesses in 2025 are fully digital. No more paper contracts or office keys – just tap, unlock, and go. In our latest article, we explore top apps (like Donkey Republic, MOBY Bikes and Forest) that show what a modern rental experience looks like. Plus, we explain where a full platform like ATOM Mobility fits in when you're ready to scale.

Running a rental or sharing business today means delivering a smooth, digital-first experience. Whether you rent cars, bikes, scooters or other vehicles – users expect to book online, pay, verify identity if needed, unlock a vehicle, and ride or drive without extra friction.

To make that happen reliably, you need good vehicle rental software or platform backing your service. Below are some successful examples of apps and platforms that show how this works and what is possible.

Operates in several European cities offering shared bikes and e‑bikes. Users find a bike in the app, unlock it with a smartphone, ride, then park at a designated drop‑off spot and end the rental. Pay‑as‑you‑go, daily rates or memberships are all handled via the app.

Targets electric bicycles and e‑cargo bikes across certain regions, with a “tap‑and‑ride” system that uses its proprietary app for booking, unlocking, and rental management. The platform supports mixed-use fleets (shared bikes, cargo bikes, delivery fleet, even B2B rentals), which illustrates flexibility – useful for operators exploring different business models beyond simple consumer rentals.

It is a dockless e‑bike sharing operator in London. It runs a large fleet and offers bike‑sharing through a mobile app. The service demonstrates how a relatively simple, dockless rental model can scale at urban level using app‑based rentals, unlocking, and flexible parking.

These examples show how micromobility‑focused services already rely on booking, payment, unlocking and fleet management tech – the same core capabilities needed by any modern vehicle rental business.

From these operators you can observe several useful traits that a good rental/sharing software should provide:

These are exactly the kinds of features you need when you move from small‑scale operation to proper fleet business.

If you plan to just test the market or to operate a larger and more complex fleet - multiple vehicle types, multiple cities, or advanced operational requirements - a full-stack platform like ATOM Mobility becomes essential.

ATOM Mobility is designed for operators who need full control over the entire mobility operation: booking flows, unlocking logic, payments, KYC/ID verification, backend administration, fleet analytics, dynamic pricing, and multi-modal rentals across cars, scooters, bikes, and more.

The platform provides a unified backend that supports cars, scooters, e-bikes, mopeds, and additional vehicle types within a single system. Operators can manage bookings, payments, users, smart locks or connected vehicles, fleet health, and city-level scaling without fragmenting their tech stack as the business grows.

This approach offers far greater flexibility than single-vehicle or bike-only solutions and removes the need to migrate systems when expanding into new vehicle categories or markets. Check out the full service here.

Join a franchising when you:

- prefer operating under an established brand

- value a clear operational playbook and central support

- want simpler marketing thanks to brand recognition

- are comfortable with limited control over technology and product decisions

- accept franchise fees or revenue sharing in exchange for convenience

- don’t need heavy customization or experimentation

Use a full platform (like ATOM Mobility) when you:

- aim to manage a larger, mixed fleet (cars, scooters, bikes, e-bikes)

- need full backend control (admin, analytics, pricing, reporting)

- require payments, KYC/ID verification, and automation built in

- want freedom to customize booking flows, pricing, and partnerships

- plan to scale across cities or add new vehicle types over time

- prioritise brand ownership and customer relationship control

- want no revenue sharing or franchise fees

For simple bike or e-bike fleets, the technology barrier is already low. Joining a franchise can be a fast way to get operations running with minimal setup.

However, operators with long-term ambitions - expanding into multiple vehicle types, scaling across locations, or maintaining consistent service quality - typically outgrow narrow tools. In those cases, a full-stack platform like ATOM Mobility offers the flexibility and control needed to support growth without rebuilding the tech foundation later.

Some operators start small and migrate as complexity increases. Others choose to build on a full platform from day one to avoid future transitions. The right choice depends on how clearly you define your growth path, desired level of control, and operational complexity from the start.

When global players skipped smaller cities, Elerent saw opportunity. They built a franchise-first network that now spans 60+ cities across Southern Europe. After migrating from another platform that struggled with complex IoT (10+ device types!), they found a scalable partner in ATOM Mobility.

🌍 When global players skipped smaller cities, Elerent saw opportunity. They built a franchise-first network that now spans 60+ cities across Southern Europe. After migrating from another platform that struggled with complex IoT (10+ device types!), they found a scalable partner in ATOM Mobility - and now they’re even taking on ride-hailing with WOPPH, a new Italian alternative to Uber.

When Alessio Treglia first encountered shared scooters on a trip to Lisbon in 2019, he instantly saw potential. At the time, Italy had no similar micromobility services, and the simplicity of the scooter-sharing experience – especially how easy it was through the app – left a strong impression.

That moment led to the creation of Elerent, a company that now operates in more than 60 cities across Italy, Malta, Greece, and Spain. Built entirely on a franchise model, Elerent empowers local entrepreneurs to run their own fleets under a unified brand and tech platform. Today, Elerent is expanding across new cities, vehicle types, and even business models – including a ride-hailing app called WOPPH, designed specifically for the Italian market.

Launch date: June 2020. Migrated to ATOM Mobility in May 2025

Country: Italy, Malta, Greece, and Spain

App downloads: Over 100,000 (Android)

App rating: 4,7 / 5 from 965+ reviews (Google Play) and 4.6 / 5 from 1600+ reviews (App Store)

Fleet: Over 4,000 vehicles across 60+ cities

Web page: https://elerent.com

App Store: https://apps.apple.com/it/app/elerent/id1518090808

Google Play: https://play.google.com/store/apps/details?id=com.elerent.elerent

Starting with inspiration – and a delayed launch

Alessio was already managing several businesses in Italy when he came across Tier scooters in Lisbon. Curious about the model and impressed by how easily it worked, he returned to Rome with the idea of starting something similar. He began researching the sector, gathered insights from local entrepreneurs, and launched a pilot project. Everything was ready by early 2020, but the pandemic delayed the official launch. Instead of stopping, Alessio used that time to study the market more deeply and refine the model. In June 2020, the first Elerent city went live.

Focusing on cities the big players skipped

From the start, Elerent’s strategy was clear: avoid direct competition with large operators like Dott or Bird in crowded urban centres. Instead, the team focused on small and mid-sized cities, especially those with strong tourism traffic. The franchise model made this possible. Local partners handled daily operations and worked directly with municipalities, while Elerent provided the brand, tech platform, and support. This approach allowed the company to scale efficiently, without needing large operational teams in each location.

One supplier per vehicle type

Elerent began with scooters, later adding bikes, mopeds, and in some cities, cars. Scooters are still the most popular option across their network, especially in resort towns. Bike sharing is growing fast and has become a key focus for expansion. Mopeds, on the other hand, have proven more complex to manage and scale. To keep things efficient, the team prefers working with a single hardware supplier per category. For scooters, that’s mostly Segway. Standardizing hardware has made training, maintenance, and spare part sourcing easier across all cities.

.jpeg)

Running the business day-to-day

Each city is run by a local entrepreneur who manages deployment, maintenance, and local relationships. These franchisees are incentivised to ensure smooth operations – they earn directly from ride revenue. Elerent monitors each location using a few simple metrics: average rides per vehicle per day, and how many vehicles are active. This helps the team identify issues like maintenance delays or low demand, and offer support where needed. “They know their cities better than we ever could,” Alessio explains. “That’s why the model works.”

Switching platforms and finding the right tech

Before partnering with ATOM Mobility, Elerent had worked with several other fleet management platforms. Alessio is direct about what he learned through that experience: frequent migrations are expensive, risky, and damaging to customer trust. “Every migration costs you money, time, and reputation,” he says. “That’s why it’s so important to choose the right software partner early and stick with them.”

After testing different solutions, Alessio chose ATOM Mobility based on the platform’s reliability, flexibility, and partner-first approach. “We found a solid product that does what we need it to do,” he says. “It’s stable, it’s scalable, and it supports our franchise structure and multi-vehicle operations across many cities. That’s not easy to find.”

He also values the working relationship. “The ATOM team actually listens. We’ve been able to suggest changes and improvements, and they respond fast,” he adds. “They understand how operators think. It’s not just a software provider – it’s a real partner.”

Smarter decisions with AI

To improve fleet performance and decision-making, Elerent has integrated Switch’s Urban Copilot – an AI-driven tool that supports operators with actionable data insights. “Everyone talks about AI, but this is one of the only tools that actually delivers results,” says Alessio. “We don’t have our own analytics team, but with Switch, we get the insights we need to make better decisions.”

Supporting local launches

Whenever a new city goes live, Elerent supports the franchisee with launch marketing, hands-on training, and operational onboarding. This includes local promotions with hotels and restaurants, technical setup, and on-the-ground support during the first week of service. The goal is to make each new launch consistent, reliable, and locally relevant.

.jpeg)

WOPPH: An alternative to ride-hailing in Italy

WOPPH (pronounced “wopp”) is Elerent’s newest product – a ride-hailing app designed specifically for the Italian market, where traditional platforms like Uber are limited to taxi dispatching. WOPPH allows private individuals to offer rides to others, using a peer-to-peer model that fits within the local legal framework. Users can book rides, view pricing, and track arrivals – all through the app (powered by ATOM Mobility). The service has already launched in Rome and is set to expand to ten more cities in the coming months.

WOPPH is also experimenting with other modes of transport, including golf carts, delivery vehicles, and even private planes for day trips. The app will also allow users to turn their personal vehicles into shared cars using IoT devices – letting drivers choose between offering rides or enabling self-service access. “It’s an ambitious product,” Alessio says. “But the market response has been very positive.”

Looking ahead: growth through opportunity

Alessio believes the timing is right for continued expansion. With hardware costs falling and large operators focusing more on profitability than growth, there’s room for companies like Elerent to expand into new markets, especially with second-hand vehicles. “We can buy nearly-new units from major suppliers at half the price,” he says. “That opens a lot of doors.”

The focus now is on growing Elerent’s reach, continuing to support franchisees, and scaling WOPPH into a national mobility platform. With multiple projects moving forward in parallel, Elerent is positioning itself as a flexible, tech-enabled operator in markets that global players often overlook.

🚗💬 Why do ride-hail drivers quit – and what makes them stay? We break down insights from the 2025 Gig Driver Report and show how ATOM Mobility helps platforms keep drivers happy with instant payouts, dynamic pricing, and smarter tools.

How to retain drivers on your ride-hailing platform long term

In the ride-hailing business, getting enough drivers online is critical. But keeping them there is what really drives long-term success. Unlike traditional taxi services, ride-hailing drivers are independent contractors. They don’t have fixed shifts, guaranteed income, or long-term contracts. They log on when it suits them, and just as quickly, they can log off – or switch to another app.

That flexibility means you're not only competing for riders. You're also competing for drivers, every single day.

What makes ride-hailing different for drivers

Compared to traditional taxis, the ride-hailing model offers drivers more independence but less security. Taxi drivers usually worked under a dispatcher, used company-owned vehicles, and followed a set schedule. Ride-hailing drivers use their own car, their own time, and often multiple apps.

The benefits are clear: flexibility, lower entry barriers, and instant access to earnings. But the downsides are just as real: unpredictable income, lack of support, and platform instability. For platforms, that means driver loyalty is fragile. Small changes – like delayed payments or fewer rides – can cause drivers to leave.

Why driver retention matters

Most ride-hailing operators focus heavily on passenger growth. But without enough reliable drivers, demand turns into frustration. When wait times grow or no vehicles are available, users abandon the app. This makes driver retention a key metric – not just for operations but also for brand trust and profitability.

It’s more expensive to onboard a new driver than to keep an experienced one. A stable driver base delivers smoother rides, higher ratings, and better service coverage. If your drivers are churning every few weeks, your entire operation becomes reactive.

Inside the 2025 Gig Driver Report

A recent survey by Everee sheds light on what drivers want - and what makes them quit. In May 2025, 419 gig drivers in the U.S. were surveyed. Most of them worked across multiple apps, including Uber, Lyft and Shipt. The full findings are available in the 2025 Gig Driver Report by Everee.

Key findings:

These numbers show how sensitive drivers are to delays, unclear policies, and inefficiencies. A small friction point in your system could be enough to push them to a competitor.

Why drivers leave

The survey also highlighted the most common reasons drivers stop working with a platform:

In short, if drivers feel their earnings or control are at risk, they move on. The ride-hailing industry is too competitive for platforms to assume drivers will stay loyal without constant support and improvement.

What platforms can do to retain drivers

To retain drivers long term, platforms need to act on what drivers value most. According to the same report, the top three areas that would increase loyalty are:

Additionally, drivers want to feel that their time is respected, their safety is prioritized, and that they are not left guessing about payments or platform changes.

How ATOM Mobility helps you build driver loyalty

With ATOM Mobility’s platform, ride-hailing operators have access to several features designed specifically with drivers in mind.

The “Offer Your Price” feature allows riders to bid slightly more during high demand or bad traffic conditions, giving drivers the chance to earn extra when it matters most.

Dynamic pricing lets operators automatically raise fares during weekends, holidays, or peak hours so that drivers earn more when demand spikes.

One of the most impactful tools is the instant revenue split system, where a driver’s commission is transferred directly to their Stripe Connect account after every successful ride. This eliminates waiting times and builds trust through real-time, transparent payouts.

To make things even smoother, ATOM Mobility offers a dedicated driver app where drivers can track performance, see earnings, and review ride history.

All of this adds up to a professional, transparent experience for drivers - and a stronger incentive to stay on your platform long term.

A dedicated driver app helps drivers track performance, earnings, and ride history. This kind of visibility increases engagement and reduces confusion. Instead of contacting support for payment questions, drivers can see everything directly in the app. The experience feels more professional and structured – which increases the chance they’ll stay longer.

You can explore the dedicated driver app in more detail on driver app overview.

Faster onboarding leads to faster activation

Another key piece of retention is how quickly drivers can get started. Platforms that make onboarding long or confusing lose drivers before the first ride. ATOM Mobility supports streamlined onboarding flows with pre-filled fields, automatic document validation, and built-in guides. In some cases, drivers can be onboarded, verified, and ready to drive within hours – not days.

A better experience creates loyalty

Drivers are not just users of your app – they are ambassadors of your brand. Every interaction they have, from the first sign-up to the latest payout, shapes how they feel about your platform. If it’s smooth, fair, and rewarding, they’re likely to stay. If not, they’ll be gone before the next weekend rush.

By investing in the right tools and understanding what really matters to drivers, platforms can reduce churn, increase satisfaction, and build a loyal driver base. And in a market where supply is everything, that loyalty pays off.

If you're building a ride-hailing operation and want to give your drivers a reason to stay, ATOM Mobility gives you the technology to make it happen. From instant payments to dynamic pricing and a dedicated driver app, everything is designed to keep your fleet active and engaged – for the long haul.

👉 ATOM Connect 2025 is an exclusive shared mobility networking event hosted by ATOM Mobility in collaboration with INVERS. This focused gathering will bring together industry leaders, innovators, and decision-makers from Europe's car-sharing and car-rental sectors to explore the future of shared mobility.

What happens when professionals from Europe’s car sharing and car rental industries gather under one roof? You get a day filled with fresh ideas, insightful discussions, and valuable connections that help shape the future of mobility. That’s what awaits at ATOM Connect 2025 - a dedicated industry event hosted by ATOM Mobility in partnership with INVERS.

This year’s gathering takes place on October 30, 2025, in Riga, Latvia, at the panoramic top floor of the AC Hotel by Marriott. With views stretching across Riga’s historic Art Nouveau district, the setting offers an inspiring backdrop for meaningful conversations about the next steps in shared mobility.

Date & Time: October 30, 2025, from 15:00 onwards

Location: AC Hotel by Marriott, Riga (top floor with panoramic views)

Hosts: ATOM Mobility & INVERS

Format: Expert talks, interactive Q&A, networking sessions, and evening drinks

Topics covered:

- Market insights from INVERS

- Scaling car sharing businesses

- Digital transformation in rentals

- Corporate mobility opportunities

- Eastern Europe’s shared mobility landscape

Learn from industry experts

The agenda is designed to address today’s most relevant mobility challenges. Expect data-driven insights from INVERS, practical strategies for scaling car sharing operations, discussions on digital rental solutions and corporate mobility, plus a closer look at the unique opportunities and challenges in Eastern Europe.

The event will also be joined by BYD, one of the world’s fastest-growing electric vehicle makers, who will showcase their innovative, affordable EVs at our event.

Build valuable connections

ATOM Connect 2025 is a focused gathering that brings together operators, rental businesses, and mobility experts from across Europe. With a mix of talks, networking breaks, and an evening reception, the event offers the perfect setting to exchange experiences, discuss challenges, and explore future partnerships.

If you’re active in car sharing or rental industry and want to stay ahead in a rapidly evolving market, ATOM Connect 2025 is a must-attend event. Together with INVERS, we’re creating a space where the European shared mobility community can connect, learn, and look toward the future.

👉 Save the date and request your spot today*: https://www.atommobility.com/atom-connect-2025

*Please note: ATOM Connect 2025 is intended for shared car mobility and car rental industry professionals. Registration requests will be reviewed before confirmation.

🌴 How e-moob became Aruba’s leading scooter operator 🚲⚡ From a Bird partnership in 2020 → to full independence with ATOM Mobility in 2023. Today: 150+ scooters in Aruba + fleet in Costa Rica. ⭐ 4.9/5 ranking on iOS & 4.8/5 on Android.

🌴 How e-moob became Aruba’s leading scooter operator 🚲⚡ From a Bird partnership in 2020 → to full independence with ATOM Mobility in 2023. Today: 150+ scooters in Aruba + fleet in Costa Rica. ⭐ 4.9/5 ranking on iOS & 4.8/5 on Android.

What began as a local partnership with Bird in 2020 has since grown into a fully independent scooter-sharing business with operations in Aruba and Costa Rica – and soon, mopeds in Spain. At the heart of this shift is e-moob’s decision to take full control of its fleet, its brand, and its technology. That control, Santos says, came with switching to ATOM Mobility.

Launch date: 2020 (with Bird), independent launch with ATOM Mobility in December 2024

Country: Aruba and Costa Rica

App Store: 4.9 / 5 ⭐

Google Play: 4.8 / 5 ⭐

Fleet: 150+ scooters in Aruba, smaller fleet in Costa Rica

Web page: https://e-moob.com

App Store: https://apps.apple.com/us/app/e-moob/id6642640340

Google Play: https://play.google.com/store/apps/details?id=e.moob.app

In a market as compact and tourism-driven as Aruba, micromobility is a unique challenge. There’s limited space, high operational costs, and intense competition for visitor attention. But for Luis Santos, co-founder of e-moob, it was also the perfect opportunity.

Starting in a market built for tourism

e-moob launched in Aruba, where the economy relies heavily on tourism - over 3 million visitors per year. Almost all of e-moob’s users are tourists, with 99% of rides coming from short-term visitors. The island’s layout and mild weather make it ideal for short scooter trips along the coastline, especially in popular resort areas.

“Aruba is a super small market, and it can get flooded quickly,” says Santos. “We learned from experience that we can’t go beyond 1,000 scooters here. So when we wanted to grow, we had to expand outside the island.”

That led to e-moob’s second market: Tamarindo, Costa Rica – another sunny, coastal town with a young, active tourist crowd. The business model remains the same: light, flexible mobility for short-distance use, tailored to tourism patterns.

Long setup, fast scale

Launching operations in Aruba wasn’t quick. “Before we even started, it took almost a year to get everything ready – registering the company, getting licenses, even just opening a bank account,” Santos explains.

The technical launch also had its challenges. When e-moob moved to its own brand using ATOM Mobility in December 2024, there were initial issues with starting rides due to firmware and hardware compatibility. “Some scooters couldn’t be unlocked properly, and we had a few tough days. But the team at ATOM Mobility helped fix it quickly, and within a week we had everything working smoothly.”

Before launching under the name e-moob, the team operated using their own brand called Evikes on the Bird platform. “That’s how Bird was working with partners back then,” says Santos. “It was our brand, but the operations were fully integrated with Bird’s system.” This setup helped them gain visibility among tourists – especially American visitors who already had the Bird app – but also came with limitations.

Switching to ATOM Mobility: Gaining control

Before launching under their own name, e-moob operated under Bird’s platform. While that brought initial visibility and trust – especially from American tourists who already had the Bird app installed – it came with limitations. All changes, pricing, or refunds had to go through Bird’s team. When parts or new scooters were needed, delays became a serious problem.

Eventually, the lack of flexibility pushed e-moob to go independent.

With ATOM Mobility, Santos and his team gained full control. “Now I can change prices, send bonuses, and refund directly. We also choose and buy our own units from Okai, instead of waiting for Bird. We manage customer service in-house. It’s been a major change.”

The result? e-moob is now operating at nearly the same revenue level with their new ATOM-powered fleet of 160 scooters as they were with their much larger Bird fleet of around 300 to 400 units. “We make almost the same amount of money with half the scooters,” says Santos. “That was an unexpected success.”

Adapting to the local market

Electricity prices in Aruba are high – around 2.5 times higher than in Miami – which directly impacts scooter charging costs. This shaped e-moob’s pricing strategy. Rides cost about $0.56 per minute and $1.07 to unlock, including the local 7% tax. These prices are slightly higher than in mainland U.S. markets but necessary to maintain profitability.

As for user features, subscriptions and loyalty programs haven’t played a big role yet. “Most of our users are tourists – they come, ride, and leave. There’s no long-term user behavior,” Santos explains.

Running the business day-to-day

Santos still handles customer support personally and uses ATOM’s admin tools daily to manage refunds, view ride history, and track issues. “We get very few support emails – maybe 10 to 15 a month, even with thousands of rides. Most issues come from signal delays when the scooters are in sleep mode.”

While e-moob doesn’t rely heavily on heatmaps or demand analytics (the team already knows exactly where to place the scooters in such a small market), the monthly dashboards and ride data remain useful for tracking performance.

Santos is also looking forward to using upcoming feature that allows tagging locations on the map – restaurants, hotels, or partner businesses – to increase visibility and engagement.

Challenges and strategic pivots

One of the biggest challenges came when Bird stopped supplying new hardware. “Our competitors arrived, and we needed new scooters, but Bird couldn’t deliver. We waited over a year, and that’s when we realized we had to build our own brand.”

Buying directly from Okai and using ATOM Mobility gave e-moob independence. It also opened the door to support multiple vehicle types. That’s essential for their next move: launching moped (Vespa-style) sharing in Spain.

“We’re already negotiating with suppliers,” says Santos. “We’re aiming to start next summer in Spain – our first European market. It’s a big step, especially since mopeds are a new category for us. New parts, new maintenance, new challenges. But we’re ready.”

Looking ahead: Europe and beyond

The moped launch in Spain isn’t just about growth. It’s a way to move into more scalable, tourism-driven markets. Aruba has reached its limit, and Costa Rica has proven slow to scale due to logistics and local bureaucracy. Europe offers a more mature market – and new opportunities.

e-moob is also in discussions with local delivery apps for third-party integrations. While current scooter zones are too limited to justify monthly fees, mopeds will expand the service range and open new B2B possibilities.

Santos is also exploring the potential of building stronger local loyalty by partnering with businesses and hotels. It’s a small use case, but one that could help bridge the gap between tourism and local use.

From hobby to ecosystem

Surprisingly, e-moob is a side business for Santos. His main company provides IT infrastructure for hotels and casinos, while he also manages a real estate firm and a smart home business in the U.S.

That existing network actually helped launch e-moob. “We started by placing scooters in private buildings developed by people I already worked with. Public spaces weren’t available at first, so private locations made it possible,” he recalls. “Now, we even have scooter parking inside the Ritz-Carlton and St. Regis hotels.”

Community, growth, and the power of being present

Santos regularly attends industry events like the Micromobility Conference. “It’s small, but valuable,” he says. “Meeting partners in person helps us move deals forward. Last year we made great connections. This year we’re closing our first moped deal because of those conversations.”

For Santos, success is not about buzzwords or fast scaling. It’s about growing smart, solving real problems, and building sustainable operations. “We’re proud of how far we’ve come. We’ve grown the fleet, expanded the business, and made something that works.”

Advice for new operators?

“Get full control from day one. Don’t depend on someone else’s rules,” Santos says. “The more control you have – over the operations, the pricing, the support – the better you can react to what your market really needs.”

With its strong base in Aruba, growing operations in Costa Rica, and exciting plans for Europe, e-moob is not just a scooter company – it’s a case study in smart, independent micromobility growth.