Insights and news from the ATOM Mobility team

We started our blog to share free valuable information about the mobility industry: inspirational stories, financial analysis, marketing ideas, practical tips, new feature announcements and more.

We started our blog to share free valuable information about the mobility industry: inspirational stories, financial analysis, marketing ideas, practical tips, new feature announcements and more.

The micromobility industry doesn’t need another generic mobility conference. 🚫🎤 It needs real conversations between operators who are actually in the field. ⚙️ That’s exactly what ATOM Connect 2026 is built for. 🎯🤝

The shared mobility industry is evolving rapidly. Operators are navigating scaling challenges, regulatory complexity, hardware decisions, fleet optimization, and new integration models, all while aiming for sustainable growth.

That’s exactly why ATOM Mobility is organizing ATOM Connect 2026.

Our previous edition of ATOM Connect brought together professionals from the car sharing and rental industry for focused, high-quality discussions and networking. This year, we are narrowing the focus and dedicating the entire event to one fast-moving segment of the industry: shared micromobility.

ATOM Connect 2026 is designed specifically for operators, partners, and decision-makers working in shared micromobility. It is not a broad mobility conference or a public exhibition. It is a curated space for industry professionals to exchange practical experience, insights, and lessons learned.

On May 14th, 2026 in Riga, we will once again bring the community together, this time with a clear focus on micromobility.

This year’s agenda will address the real operational and strategic questions shaping shared micromobility today:

As usual, we aim to host both local and international operators from smaller, fast-growing fleets to established large-scale players alongside hardware providers and ecosystem partners.

On stage, you’ll hear from leading shared mobility companies - including Segway on hardware partnerships, Umob on MaaS integration, Anadue on data-driven fleet intelligence, Elerent on multi-vehicle operational realities and more insightful discussions.

The goal is simple: meaningful discussions with people who understand the operational realities of the industry.

ATOM Connect is free to attend, but participation is industry-focused (each submission is manually reviewed and verified). We are intentionally keeping the audience relevant and aligned to ensure high-quality conversations and valuable networking.

If you work in shared micromobility and would like to join the event, you can find the full agenda and register here:

👉 https://www.atommobility.com/atom-connect-2026

In the coming weeks, we will be revealing more speakers and additional agenda updates. We look forward to bringing the industry together again.

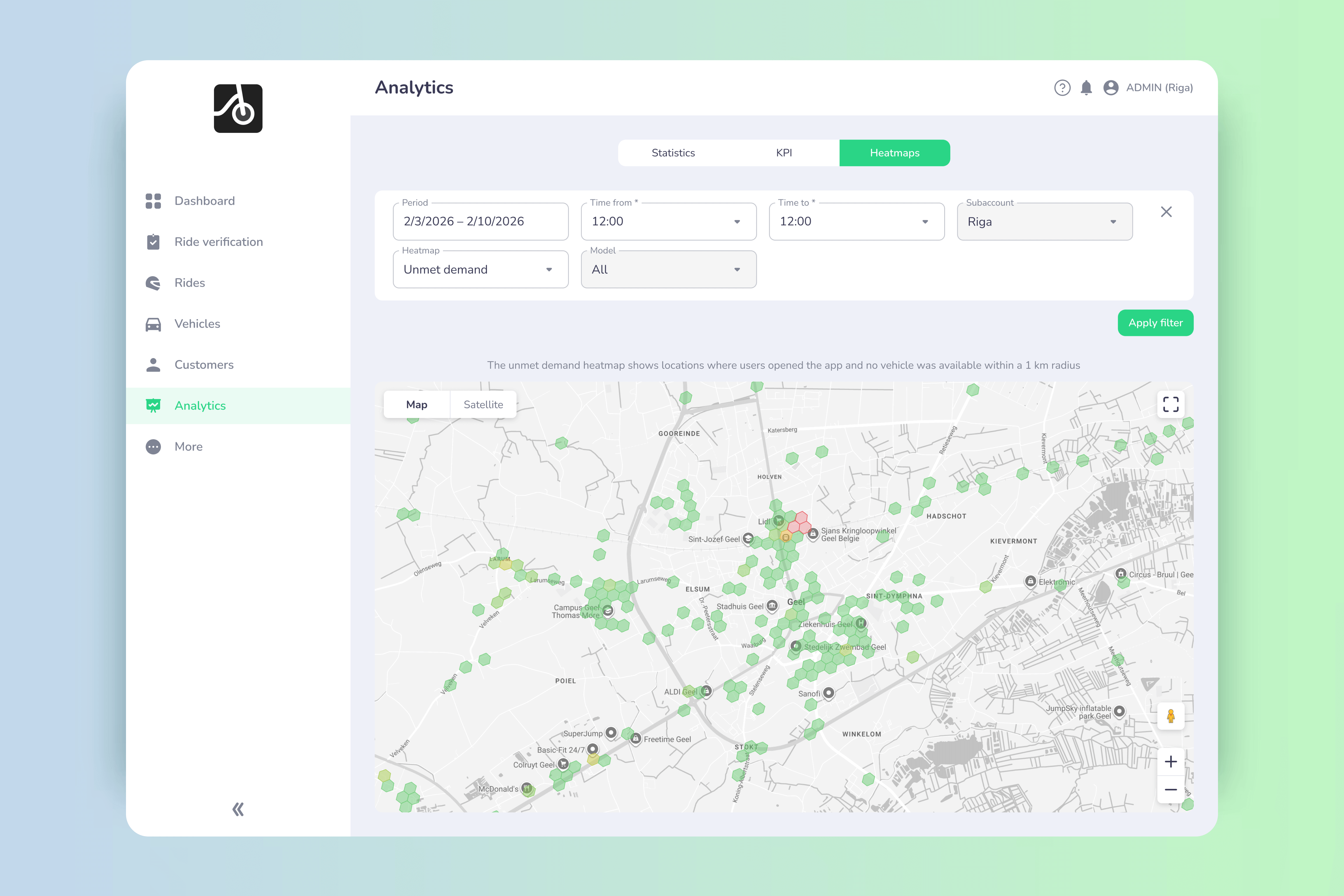

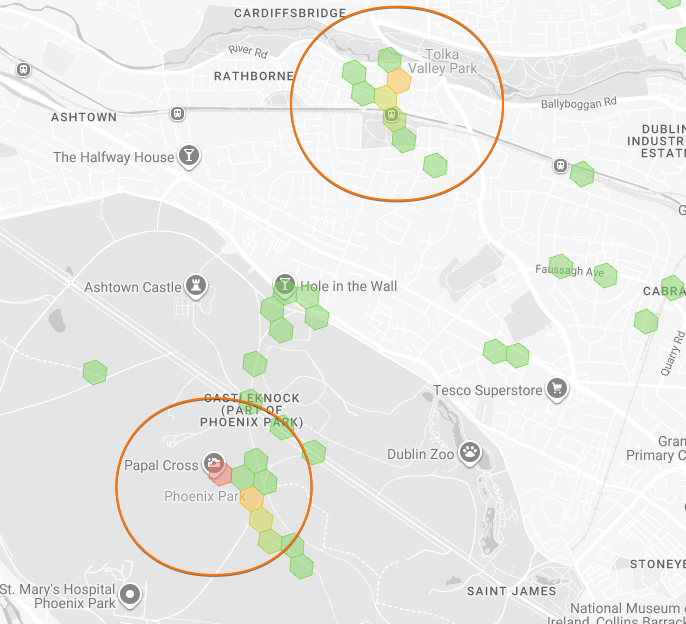

📉 Every unmet search is lost revenue. The unmet demand heatmap shows where users actively searched for vehicles but none were available - giving operators clear, search-based demand signals to rebalance fleets 🚚, improve conversions 📈, and grow smarter 🧠.

Fleet operators don’t lose revenue because of lack of demand - they lose it because demand appears in the wrong place at the wrong time. That’s exactly the problem the Unmet demand heatmap solves.

This new analytics layer from ATOM Mobility shows where users actively searched for vehicles but couldn’t find any within reach. Not guesses. Not assumptions. Real, proven demand currently left on the table.

The unmet demand heatmap highlights locations where:

In other words: high-intent users who wanted to ride, but couldn’t. Unlike generic “app open” data, unmet demand is recorded only when a real vehicle search happens, making this one of the most actionable datasets for operators.

Many analytics tools track where users open the app (ATOM Mobility provides this data too). That’s useful - but incomplete. Unmet demand answers a much stronger question:

Where did users try to ride and failed? That difference matters.

Unmet demand data is:

✅ Intent-driven (search-based, not passive)

✅ Directly tied to lost revenue

✅ Immediately actionable for rebalancing and expansion

✅ Credible for discussions with cities and partners

Here’s how the logic is implemented under the hood:

1. Search-based trigger. Unmet demand is recorded only when a user performs a vehicle search. No search = no data point.

2. Distance threshold. If no vehicle is available within 1,000 meters, unmet demand is logged.

3. Shared + private fleet support. The feature tracks unmet demand for:

This gives operators a full picture across all use cases.

4. GPS validation. Data is collected only when:

This ensures accuracy and avoids noise.

To prevent multiple searches from the same user artificially inflating demand, the system applies intelligent filtering:

- After a location is stored, a 30-minute cooldown is activated

- If the same user searches again within 30 minutes And within 100 meters of the previous location → the record is skipped

- After 30 minutes, a new record is stored - even if the location is unchanged

Result: clean, realistic demand signals, not spammy heatmaps.

Unmet demand shows exactly where vehicles are missing allowing you to:

🚚 Smarter rebalancing

Instead of guessing where to move vehicles, teams can prioritize:

🏙 Stronger city conversations

Unmet demand heatmaps are powerful evidence for:

📊 Higher conversion rates

Placing vehicles where users actually search improves:

The new unmet demand heatmap is designed to work alongside other analytics layers, including:

- Popular routes heatmap

- Open app heatmap

- Start & end locations heatmap

Operators can also:

Every unmet search is a signal. Every signal is a potential ride. Every ride is revenue. With the unmet demand heatmap, operators stop guessing and start placing vehicles exactly where demand already exists.

👉 If you want to see how unmet demand can unlock growth for your fleet, book a demo with ATOM Mobility and explore how advanced heatmaps turn data into decisions.

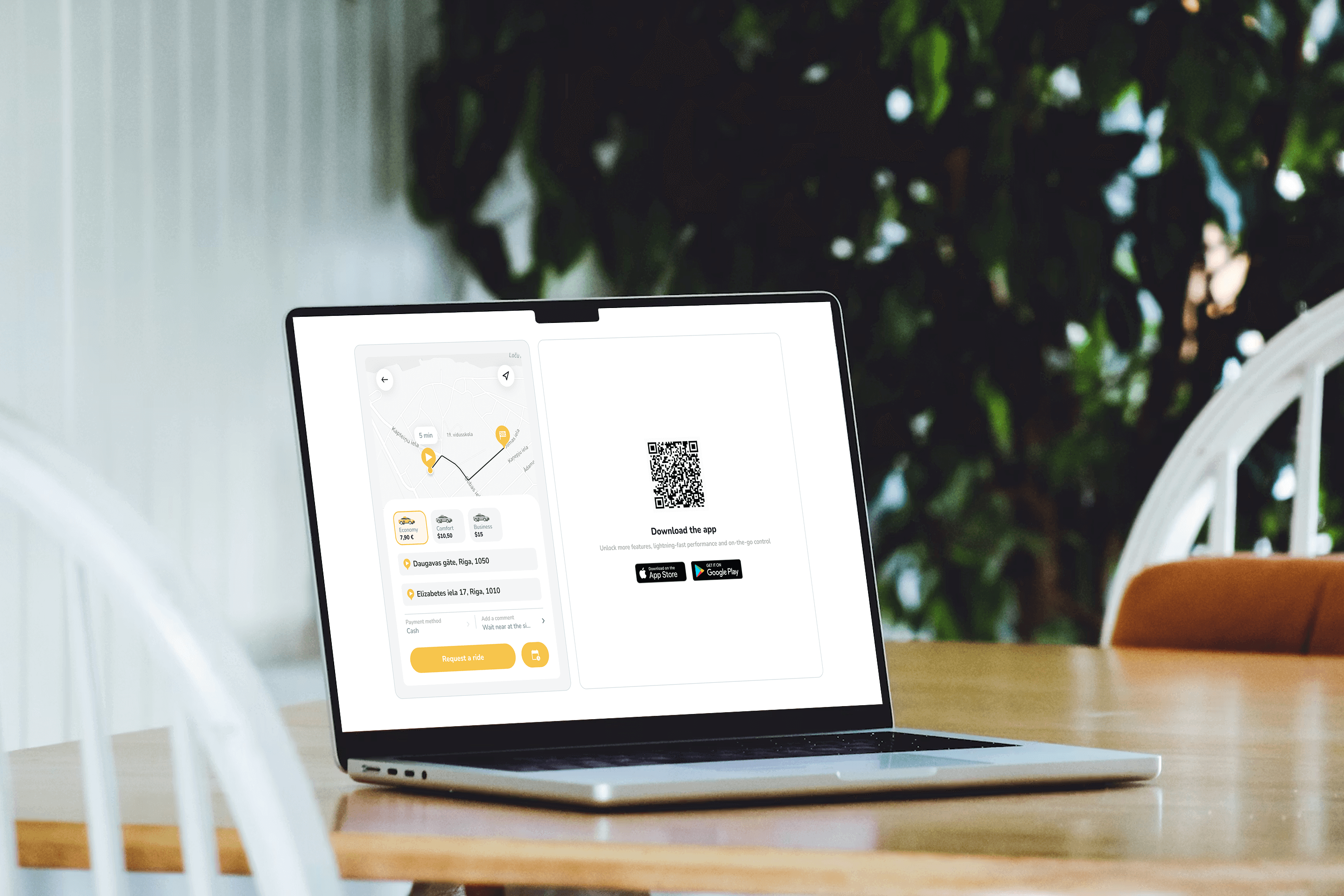

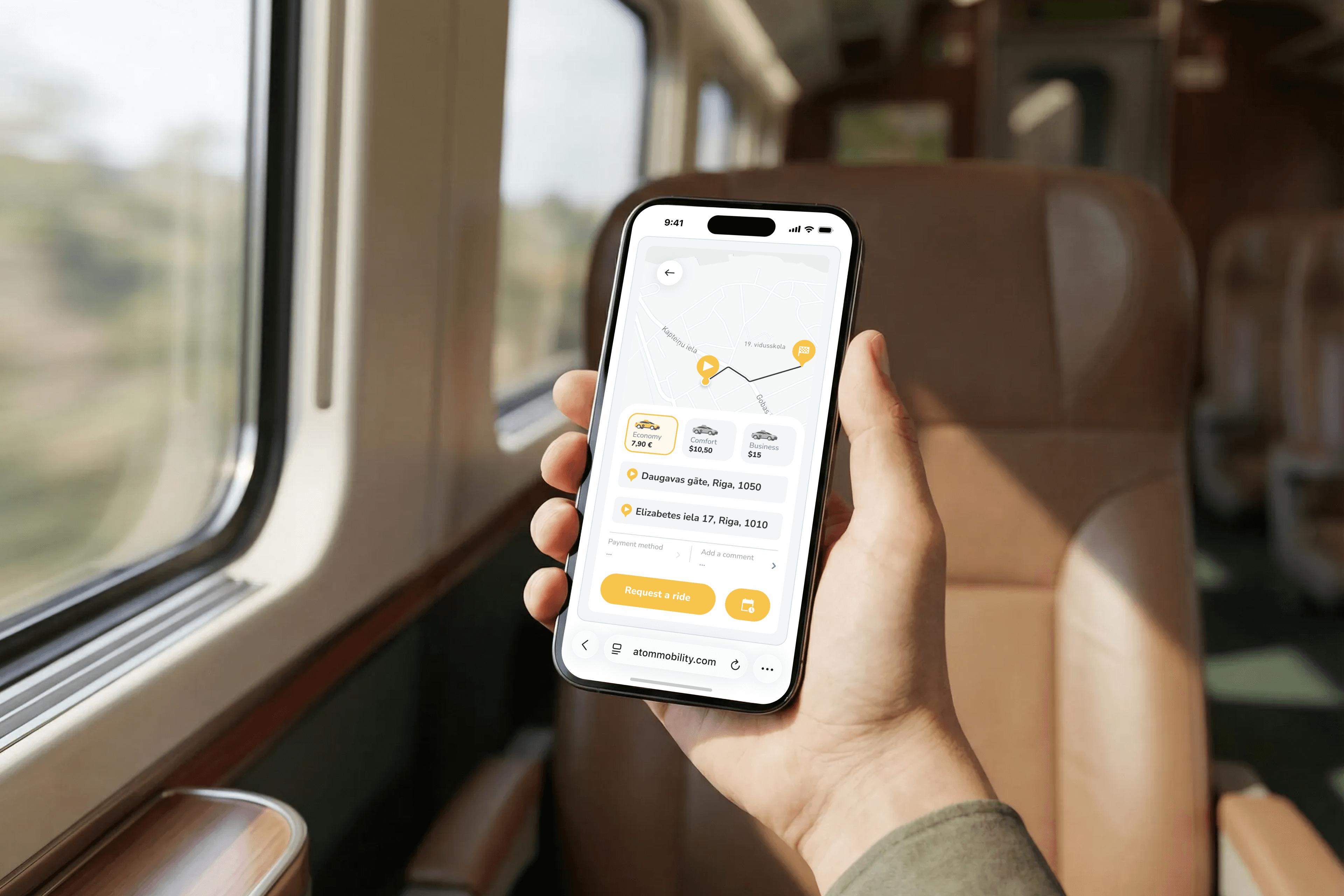

🚕 Web-booker is a lightweight ride-hail widget that lets users book rides directly from a website or mobile browser - no app install required. It reduces booking friction, supports hotel and partner demand, and keeps every ride fully synced with the taxi operator’s app and dashboard.

What if ordering a taxi was as easy as booking a room or clicking “Reserve table” on a website?

Meet Web-booker - a lightweight ride-hail booking widget that lets users request a cab directly from a website, without installing or opening the mobile app.

Perfect for hotels, business centers, event venues, airports, and corporate partners.

👉 Live demo: https://app.atommobility.com/taxi-widget

Web-booker is a browser-based ride-hail widget that operators can embed or link to from any website.

The booking happens on the web, but the ride is fully synchronized with the mobile app and operator dashboard.

No redirects. No app-store friction. No lost users.

This keeps fraud low while preserving conversion.

Web-booker addresses one of the most common friction points in ride-hailing: users who need a ride now but are not willing to download an app first. By allowing bookings directly from a website, operators can capture high-intent demand at the exact moment it occurs - whether that is on a hotel website, an event page, or a partner landing page.

At the same time, Web-booker makes partnerships with hotels and venues significantly easier. Instead of complex integrations or manual ordering flows, partners can simply place a button or link and immediately enable ride ordering for their guests. Importantly, this approach does not block long-term app growth. The booking flow still promotes the mobile app through QR codes and store links, allowing operators to convert web users into app users over time - without forcing the install upfront.

Web-booker is not designed to replace the mobile app. It extends the acquisition funnel by adding a low-friction entry point, while keeping all bookings fully synchronized with the operator’s app and dashboard.

👉 Try the demo

https://app.atommobility.com/taxi-widget

Want to explore a ride-hail or taxi solution for your business - or migrate to a more flexible platform? Visit: https://www.atommobility.com/products/ride-hailing

🚲 Cleaner air, less traffic, and better city living - bike-sharing apps are making it happen. With seamless apps, smart integration, and the right infrastructure, shared bikes are becoming a real alternative to cars in cities across Europe.💡 See how bike-sharing supports sustainable mobility and what cities and operators can do to get it right.

Bike-sharing apps are reshaping urban mobility. What began as a practical way to get around without owning a bike is now part of a bigger shift toward sustainable transport.

These services are doing more than replacing short car trips. They help cities cut emissions, reduce congestion, improve health, and connect better with public transport.

As more cities rethink how people move, bike sharing continues to grow as one of the fastest and most affordable tools to support this change.

Bike-sharing services now operate in over 150 European cities, with more than 438,000 bikes in circulation. These systems help prevent around 46,000 tonnes of CO₂ emissions annually and reduce reliance on private cars in dense urban areas. They also improve air quality, lower noise levels, and make cities more pleasant to live in.

A recent study by EIT Urban Mobility and Cycling Industries Europe, carried out by EY, found that bike-sharing services generate around €305 million in annual benefits across Europe. This includes reduced emissions, lower healthcare costs, time saved from less congestion, and broader access to jobs and services.

For cities, the numbers speak for themselves: every euro invested yields a 10% annual return, generating €1.10 in positive externalities. By 2030, these benefits could triple to €1 billion if bike-sharing is prioritized.

Bike sharing works best when it fits into the wider transport system. Most car trips that bike sharing replaces are short and often happen when public transport doesn’t quite reach the destination. That last kilometer between a bus stop and your home or office can be enough to make people choose the car instead.

Placing shared bikes near metro stations, tram stops, or bus terminals makes it easier for people to leave their cars behind. This “last-mile” connection helps more people use public transport for the long part of their trip and hop on a bike for the short part. Over time, that encourages more consistent use of both bikes and transit.

In cities where bike sharing is integrated into travel passes or mobility platforms, users can combine modes in a single journey. That flexibility supports wider access and makes shared bikes part of everyday mobility, not just something used occasionally.

The digital experience behind bike sharing is a big part of why it works. People can check availability, unlock a bike, pay, and end their trip – all in one app. This makes it quick, simple, and consistent.

Good bike-sharing apps also offer:

When users don’t need to think twice about how the system works, they’re more likely to build regular habits around it. That habit shift is what makes a long-term difference for both users and cities.

Bike sharing isn’t just a transport service. It helps cities meet public goals – cleaner air, lower traffic, healthier residents, and better access to services. When someone chooses a bike instead of a car, it reduces the demand for fuel, parking, and space on the road.

The €305 million annual benefit includes health savings due to increased physical activity, avoided emissions, time gained from reduced congestion, and the creation of jobs tied to fleet operations. Many bike-sharing schemes also improve equity by giving people access to mobility in areas that are underserved by public transport or where car ownership isn’t affordable.

Shared bikes are especially useful in mid-sized cities where distances are manageable and car traffic still dominates. With the right policy support, even small fleets can have a noticeable impact on mobility patterns and public health.

Not every bike-sharing system succeeds. To be reliable and scalable, a few things must work together:

Successful systems often grow in partnership with city governments, public transport agencies, and private operators who bring technology, logistics, and know-how.

Reliable software is what keeps all parts of the system connected. From unlocking a bike to seeing usage trends across the city, operators need tools that are stable, flexible, and easy to manage. For those launching or scaling a fleet, platforms like ATOM Mobility offer ready-made solutions that handle booking, payments, ID checks, live tracking, and fleet control in one place.

The platform supports both electric and mechanical bikes, offers branded apps, and integrates with smart locks or IoT modules for remote vehicle access. It also lets operators adjust pricing, monitor vehicle health, and manage customer support in real time. That means smaller teams can launch faster and scale smarter, without having to build every tool from scratch.

Bike sharing won’t replace all car trips, but even a small shift makes a difference. A few short rides per week can reduce emissions, improve fitness, and save time spent in traffic. When these trips are supported by good infrastructure, public awareness, and seamless apps, the impact grows.

As cities continue to prioritise sustainability, shared micromobility will play a bigger role in helping people move in cleaner, healthier, and more flexible ways. With the right technology and planning, bike sharing becomes more than a service – it becomes a habit that supports better cities for everyone.

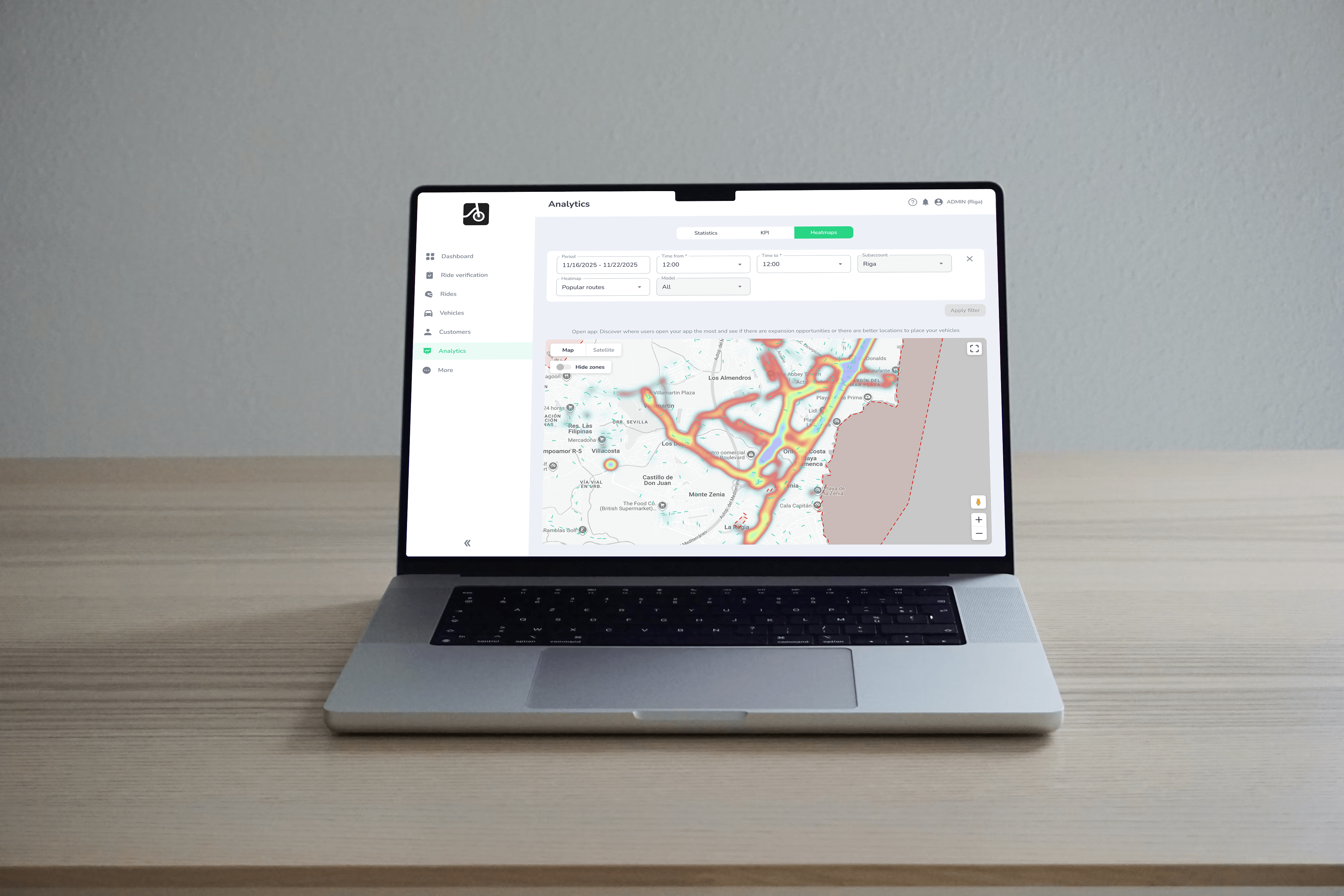

📊 One of the most requested features in ATOM Mobility is finally live. Meet Popular route heatmap - a new analytics layer that shows which streets and areas your riders actually use most, based on real ride data over time.

📊 One of the most requested features in ATOM Mobility is finally live. Meet Popular route heatmap - a new analytics layer that shows which streets and areas your riders actually use most, based on real ride data over time.

Until now, operators could see where rides start and end. Now you can see how people move in between.

Why it matters?

With Popular Route Heatmap, operators can:

🚲 Optimize vehicle placement based on real rider behavior

🏙️ Support discussions with municipalities using clear, visual usage data

📍 Identify missing infrastructure where demand already exists

📊 Make smarter, data-backed operational decisions

The feature was the #1 most upvoted idea on our merchant suggestion platform for years - and we’re excited to finally ship it.

.png)

How to use it

Go to Analytics → Heatmaps

Select heatmap type Popular routes

Filter by time period and city

Zoom in to see the busiest routes your riders take

Data availability: Popular route data is available from November 1, 2025 and will continue accumulating going forward.

Inspired by how athletes analyze movement patterns with Strava - now applied to shared mobility operations.