As shared mobility continues to experience rapid growth – projected to generate up to $1 trillion in consumer spending by 2030 – it's no wonder that entrepreneurs are drawn to explore opportunities in this thriving market.

However, despite the optimistic market outlook, the shared mobility industry doesn't provide a magic shortcut to massive and instant returns on investment – despite what some players in the industry might claim. In this blog post, we'll offer a realistic and experienced-based assessment of the investment needed to get a shared mobility venture off the ground.

We will explore how much capital you need to kickstart your own shared mobility business. With experience in supporting over 100 entrepreneurs worldwide, ATOM Mobility is in a good position to understand the financial details.

We'll discuss the essential expenses involved, including vehicles, software, insurance, and operational costs – the aim is to help you make informed decisions and kickstart your entrepreneurial journey with confidence.

Vehicle costs: how much will you pay?

The most significant cost in starting a shared mobility business comes from getting the vehicles.

Here's what you can expect to pay for a single vehicle:

- Scooters: 750-1000 EUR

- E-bikes: 1300-2500 EUR

- Mopeds: 2000-4000 EUR

- Cars: 12000-20000 EUR

Considering the higher costs associated with vehicles like mopeds and cars, leasing is also a viable option. However, securing leasing partnerships is more challenging for operators without an established business.

The choice of vehicles will ultimately depend on your business model – whether you want to provide affordable or high-end options. For instance, if you opt for top-of-the-line scooters from brands like Segway and Äike, expect to pay over 1000 EUR per vehicle. On the flip side, you can find scooters as low as 400 EUR on the Chinese market, but such a price tag comes with its own set of risks.

Optimal starting fleet size for scooter-sharing businesses

Assuming you've made your decision on the model and brand, the next question is: how many vehicles should you buy? What's the ideal fleet size to start with?

We will focus on scooters – with their affordable price tag, they have become a favored choice for those looking to venture into the shared mobility industry.

Based on what we've seen, operators kickstart their ventures with fleets of different sizes. Some start with a humble fleet of 20 scooters in their first season and then steadily grow to over 100 vehicles in the following seasons, even diversifying into cars and other modes of transportation.

However, starting with a larger fleet offers distinct advantages. Having a bigger fleet means more people will notice your brand, leading to faster adoption of shared mobility within the local community. In other words – a larger fleet speeds up the process of making shared mobility a part of people's everyday commuting routines.

Another crucial point is that operating costs remain relatively consistent for a fleet of up to 200 vehicles. Beyond that, you'll likely need to expand your team, acquire more vans, secure a larger warehouse, and hire an additional technician. But, if you're starting out small, 20 vehicles instead of 100-200 won't lead to significant cost savings in operating expenses. Therefore, it's more cost-effective to begin with a larger number of vehicles from the outset.

Maintenance and insurance

Maintenance costs are also an important consideration. On average, around 10-15% of your fleet will require ongoing maintenance, depending on the brand and model of the vehicles. With a smaller fleet of 20 scooters, it's statistically likely that 2-3 units will be undergoing repairs at any given time. In case your fleet experiences a series of unfortunate incidents, this percentage can quickly escalate, leading to a decrease in the number of scooters generating revenue.

Securing third-party public liability insurance for smaller fleets, which is required by law to protect pedestrians and riders in the event of accidents, can be a challenging task. No matter the fleet size, operators are required to pay an annual premium. This means that smaller fleets, like those with only 20 scooters, could end up paying the same premium as fleets with 150 scooters. For a smaller business, this expense can be quite prohibitive and difficult to manage. Thus, insurance costs are another reason to consider starting with a bigger fleet.

On average, the insurance costs around 8 EUR per scooter per month (paid annually) for fleets ranging from 100 to 200 scooters. These costs may vary depending on the specific coverage requirements set by local authorities.

Aim for 100 scooters – or 50 if you're low on cash

If we take into account brand visibility, maintenance, and insurance, it’s advisable for new operators to aim for a fleet size of at least 50 scooters. It’s a budget-friendly choice, especially in a location with strong market demand. A fleet of this size can also serve as a market test run.

However, for a more robust start, an ideal fleet size would be 100 scooters. As we mentioned earlier, the operating costs for both 50 and 100 vehicles would be more or less the same. However, opting for 100 vehicles instead of 50 would result in double the revenue. This boost in revenue would make it easier to sustain and expand the business. Having more vehicles would also contribute to better brand visibility in the long run.

Shared mobility software costs and considerations

Once you've got the fleet sorted, the next step is to get your hands on some software.

When it comes to shaping your brand identity, the software you use is just as crucial as the vehicles you offer. Having a top-notch fleet is great, but it won't make a difference if you neglect the software side of your shared mobility service. You want users to easily find, book, and pay for your rides without any trouble.

When it comes to white-label software pricing, it usually involves a one-time setup fee plus a monthly subscription fee based on the number of vehicles – or a dynamic pricing model per usage.

The setup fees for white-label software are typically between 4-10k EUR, depending on the provider and features. The monthly fees will vary based on fleet size or usage.

ATOM Mobility white-label software offers a wide choice of setup options, catering to fleets of all sizes, starting from the smallest and going all the way up to 5k+ vehicles. There is also a special plan for those who want to dip their toes in the water with 20 or fewer vehicles, which doesn’t require a setup fee. It's a great way to test the market and get started without breaking the bank.

Starting your shared mobility venture with 70k

Now that we've got the basics covered, let's crunch some numbers and calculate the amount of money you'll need to kickstart your scooter-sharing business.

Taking into account the costs of vehicles, software, insurance, and other expenses, we're looking at 70,000 EUR.

Here's what you'll need to kickstart your business and keep it running for at least one season:

- 40k for buying 50 scooters

- 10k to procure and maintain software for the season

- 7-10k for insurance coverage

- 5k for a warehouse

- 5k for renting a van

On top of that, you need to consider the ongoing operating costs, which will fluctuate based on the size of your fleet. If you have a fleet of 50-150 scooters, it can be efficiently managed by two owners – or one owner and a couple of part-time employees. The expense of charging the vehicles will depend on the local prices in your area.

So, with around 70k in your pocket, you'll have a decent budget to make things happen in the first year. You can prove your concept, test the market, and learn the ropes along the way. And once you've got a solid foundation, scaling up in the second year becomes a lot easier. Investors will feel more confident jumping on board when they see that your business model is actually viable.

Of course, the 70k figure is not set in stone. The actual expenses will vary based on your location and your willingness to take on additional risks. We've had operators who achieved success with just half that budget – but their journey was certainly more nerve-wracking as a result.

With our suggested budget, you'll also have some breathing space for trial and error as you kick off your venture. This kind of money allows for a smoother and less stressful launch – also increasing the chances of steady growth in the next season.

If you're interested in starting your own shared mobility venture, join our ATOM Academy for FREE to learn more and see if it's the right business for you.

If you'd like to explore the software costs in detail, schedule a demo with our team today.

Click below to learn more or request a demo.

The micromobility industry doesn’t need another generic mobility conference. 🚫🎤 It needs real conversations between operators who are actually in the field. ⚙️ That’s exactly what ATOM Connect 2026 is built for. 🎯🤝

The shared mobility industry is evolving rapidly. Operators are navigating scaling challenges, regulatory complexity, hardware decisions, fleet optimization, and new integration models, all while aiming for sustainable growth.

That’s exactly why ATOM Mobility is organizing ATOM Connect 2026.

Our previous edition of ATOM Connect brought together professionals from the car sharing and rental industry for focused, high-quality discussions and networking. This year, we are narrowing the focus and dedicating the entire event to one fast-moving segment of the industry: shared micromobility.

ATOM Connect 2026 is designed specifically for operators, partners, and decision-makers working in shared micromobility. It is not a broad mobility conference or a public exhibition. It is a curated space for industry professionals to exchange practical experience, insights, and lessons learned.

On May 14th, 2026 in Riga, we will once again bring the community together, this time with a clear focus on micromobility.

What to expect

This year’s agenda will address the real operational and strategic questions shaping shared micromobility today:

- Scaling fleets sustainably

- Multi-vehicle operations beyond scooters

- Regulatory cooperation and long-term city partnerships

- Data-driven fleet optimization

- MaaS integration and ecosystem collaboration

- Marketing and automation for growth

As usual, we aim to host both local and international operators from smaller, fast-growing fleets to established large-scale players alongside hardware providers and ecosystem partners.

On stage, you’ll hear from leading shared mobility companies - including Segway on hardware partnerships, Umob on MaaS integration, Anadue on data-driven fleet intelligence, Elerent on multi-vehicle operational realities and more insightful discussions.

The goal is simple: meaningful discussions with people who understand the operational realities of the industry.

A curated, industry-focused event

ATOM Connect is free to attend, but participation is industry-focused (each submission is manually reviewed and verified). We are intentionally keeping the audience relevant and aligned to ensure high-quality conversations and valuable networking.

If you work in shared micromobility and would like to join the event, you can find the full agenda and register here:

👉 https://www.atommobility.com/atom-connect-2026

In the coming weeks, we will be revealing more speakers and additional agenda updates. We look forward to bringing the industry together again.

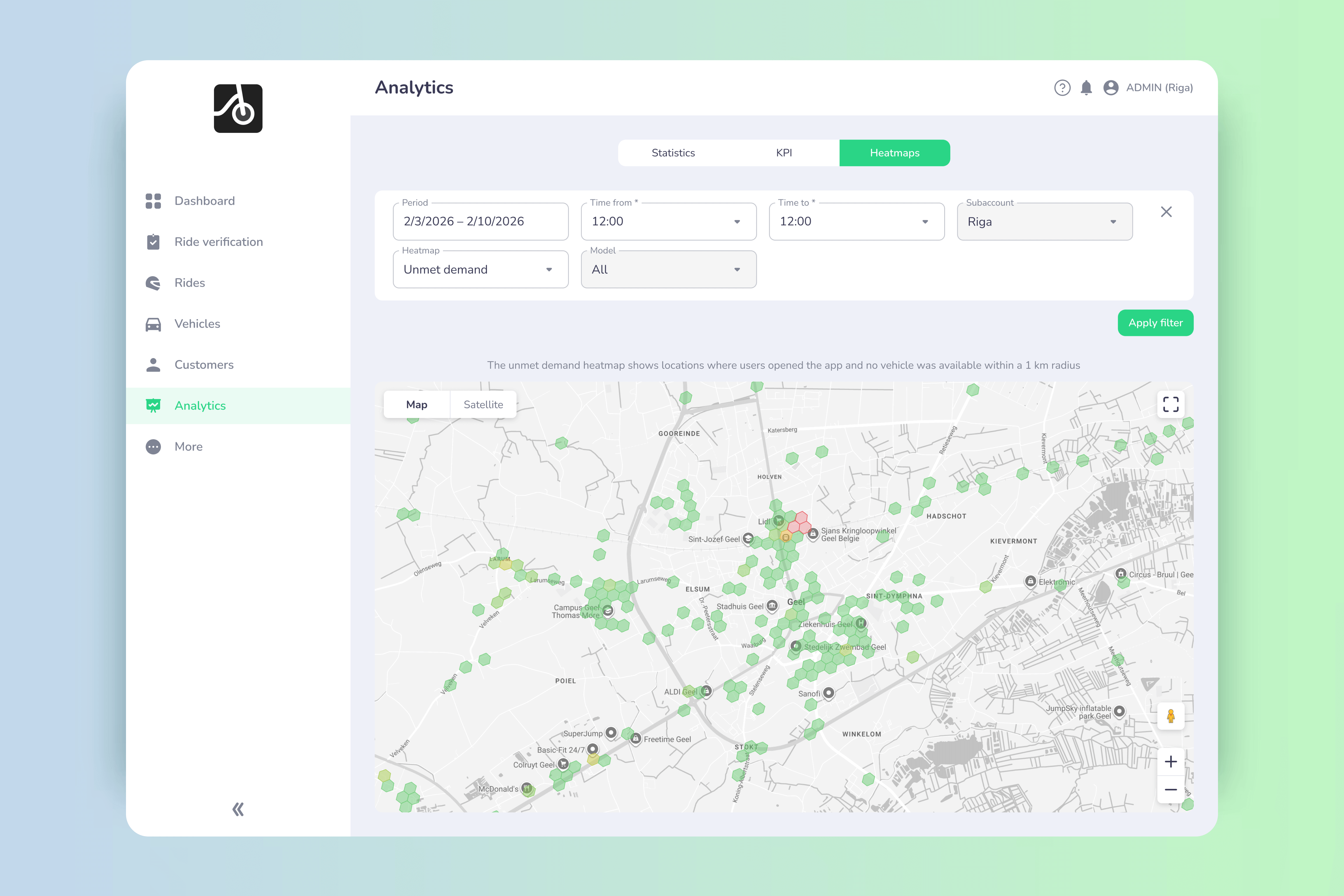

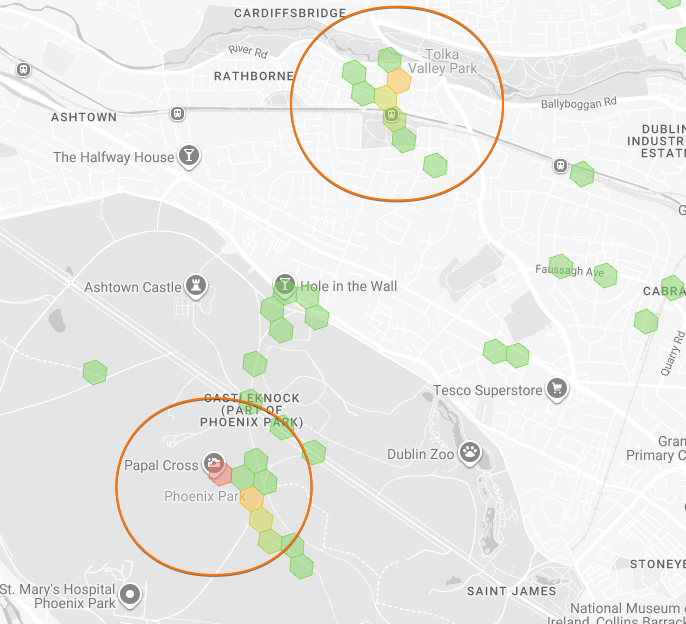

📉 Every unmet search is lost revenue. The unmet demand heatmap shows where users actively searched for vehicles but none were available - giving operators clear, search-based demand signals to rebalance fleets 🚚, improve conversions 📈, and grow smarter 🧠.

Fleet operators don’t lose revenue because of lack of demand - they lose it because demand appears in the wrong place at the wrong time. That’s exactly the problem the Unmet demand heatmap solves.

This new analytics layer from ATOM Mobility shows where users actively searched for vehicles but couldn’t find any within reach. Not guesses. Not assumptions. Real, proven demand currently left on the table.

What is the unmet demand heatmap?

The unmet demand heatmap highlights locations where:

- A user opened the app

- Actively searched for available vehicles

- No vehicle was found within the defined search radius

In other words: high-intent users who wanted to ride, but couldn’t. Unlike generic “app open” data, unmet demand is recorded only when a real vehicle search happens, making this one of the most actionable datasets for operators.

Why unmet demand is more valuable than app opens

Many analytics tools track where users open the app (ATOM Mobility provides this data too). That’s useful - but incomplete. Unmet demand answers a much stronger question:

Where did users try to ride and failed? That difference matters.

Unmet demand data is:

✅ Intent-driven (search-based, not passive)

✅ Directly tied to lost revenue

✅ Immediately actionable for rebalancing and expansion

✅ Credible for discussions with cities and partners

How it works

Here’s how the logic is implemented under the hood:

1. Search-based trigger. Unmet demand is recorded only when a user performs a vehicle search. No search = no data point.

2. Distance threshold. If no vehicle is available within 1,000 meters, unmet demand is logged.

- The radius can be customized per operator

- Adaptable for dense cities vs. suburban or rural areas

3. Shared + private fleet support. The feature tracks unmet demand for:

- Shared fleets

- Private / restricted fleets (e.g. corporate, residential, campus)

This gives operators a full picture across all use cases.

4. GPS validation. Data is collected only when:

- GPS is enabled

- Location data is successfully received

This ensures accuracy and avoids noise.

Smart data optimization (no inflated demand)

To prevent multiple searches from the same user artificially inflating demand, the system applies intelligent filtering:

- After a location is stored, a 30-minute cooldown is activated

- If the same user searches again within 30 minutes And within 100 meters of the previous location → the record is skipped

- After 30 minutes, a new record is stored - even if the location is unchanged

Result: clean, realistic demand signals, not spammy heatmaps.

Why this matters for operators

📈 Increase revenue

Unmet demand shows exactly where vehicles are missing allowing you to:

- Rebalance fleets faster

- Expand into proven demand zones

- Reduce failed searches and lost rides

🚚 Smarter rebalancing

Instead of guessing where to move vehicles, teams can prioritize:

- High-intent demand hotspots

- Time-based demand patterns

- Areas with repeated unmet searches

🏙 Stronger city conversations

Unmet demand heatmaps are powerful evidence for:

- Permit negotiations

- Zone expansions

- Infrastructure requests

- Data-backed urban planning discussions

📊 Higher conversion rates

Placing vehicles where users actually search improves:

- Search → ride conversion

- User satisfaction

- Retention over time

Built for real operational use

The new unmet demand heatmap is designed to work alongside other analytics layers, including:

- Popular routes heatmap

- Open app heatmap

- Start & end locations heatmap

Operators can also:

- Toggle zone visibility across heatmaps

- Adjust time periods (performance-optimized)

- Combine insights for strategic fleet planning

From missed demand to competitive advantage

Every unmet search is a signal. Every signal is a potential ride. Every ride is revenue. With the unmet demand heatmap, operators stop guessing and start placing vehicles exactly where demand already exists.

👉 If you want to see how unmet demand can unlock growth for your fleet, book a demo with ATOM Mobility and explore how advanced heatmaps turn data into decisions.