The bike-sharing industry is on the rise. It is the only mobility industry that statistics indicate didn't experience significant losses during the pandemic. The future is also bright as there are government initiatives around the world to support bike-sharing. However, there are things that newcomers in the business can learn from the previous leaders - success in the industry with high demand is no guarantee that the company will be a success.

A bike is a comfortable means of transportation in regions where motorized vehicles are widely used but create heavy traffic jams and pollute the air. This is a problem in regions like Asia-Pacific, North America, and Europe. And this is where and why bike-sharing has become popular. According to the Statista Mobility Outlook, bike-sharing was the only mobility sector that grew its global revenues during the pandemic by a third in 2020. The single-person set-up and open-air nature of bike riding made it the perfect mode of transportation for the pandemic.

Bike-sharing is a shared transport service in which convectional bikes or electric bikes are made available for shared use to individuals on a short-term basis for a price or free. Development of software, GPS technologies, mobile payments, and IoT devices, as well as reduced locking and tracking system costs for bikes, have recently led to the popularity of a dockless bike-sharing system that allows users to leave the bike anywhere convenient.

According to Mordor Intelligence, the bike-sharing market was valued at USD 3 billion in 2020, and it is anticipated that it will reach USD 4 billion by 2026. The COVID-19 pandemic affected the bike-sharing sector in several countries. The most negative consequences were the daily decline in bike bookings.

Bike demand is majorly driven by developing countries, such as China and India that especially focus on e-bikes. China has always been the largest exporter of e-bikes. According to China’s Ministry of Industry and Information Technology, the country's output of electric bicycles reached 25.48 million during the first 10 months of 2020, a year-on-year increase of 33.4%. During this period, the revenue of major bicycle manufacturing companies reached about USD 22 billion, an increase of 16.8%. According to the China Bicycle Association, from January to September 2020, the volume of bicycle exports was 12% up on the same period last year, rising to USD 2.43 billion.

However, the bike-sharing market growth in Europe is predicted to be the fastest across the globe, as it is anticipated that a large number of service providers will venture into the region in the coming years. In regional countries, bikes are being rapidly made available near major transit hubs, such as railway stations, thereby offering users convenience and ease of travel. In addition, the European Union (EU) also promotes such services, because they are environment-friendly and help to reduce traffic.

Global bike-sharing service market size between 2020 and 2026 in billion U.S. dollars according to Statista:

Currently, major players in the bike-sharing market are:

- Uber Technologies Inc. - provides opportunities to rent a bike in a partnership with Lime. Jump brand bikes are available after Lime acquired the Jump company.

- Lyft Inc. - in November 2018, Lyft acquired Motivate, a bicycle-sharing system and the operator of Capital Bikeshare and Citi Bike. It thus became the largest bike-share service in the United States.

- Hellobike - a transportation service platform based in Shanghai, China. Founded in 2016, the company merged with Youon Bike the following year. In a series of fundraising rounds dating back to 2016, Hellobike has raised over US$1.8 billion from investors.

- DiDi Bike - Didi Chuxing Technology Co. is a Chinese vehicle for hire company headquartered in Beijing with over 550 million users and tens of millions of drivers. The company provides app-based transportation services, including bike-sharing.

The biggest companies in the market are associated with China as are the biggest deals. Looking at the recent biggest deals in bike-sharing, the first worth mentioning involved Didi Chuxing’s bike-sharing arm Qingju. It raised USD 600 million in a Series B equity fundraising round and will be granted an additional USD 400 million in loans.

What was also interesting that at the end of 2020 the mobile application of Mobike, one of China's earliest and largest bike-sharing providers, went offline after its acquisition by Meituan three years before. Mobike was acquired by Meituan for USD 2.7 billion in April 2018. In January 2019, in an internal letter to employees Wang Huiwen, co-founder and Senior Vice-President of Meituan, informed them that Mobike will be renamed Meituan Bike and that the firm would become a unit of the new parent's location-based service department.

The growing interest in e-bikes

One trend that will definitely influence the industry in the near future is the growing interest in e-bike sharing. Pedelecs or pedal electric cycles or EPAC (Electronically Power Assisted Cycles) are becoming increasingly popular. This is a type of electric bicycle where the rider’s pedaling is assisted by a small electric motor. Such vehicles are capable of higher speeds, compared to manually operated bikes. As the demand for higher speeds for short-distance traveling increases, so does the preference for e-bikes. People are ignoring the fact that sharing services on pedal-assisted bikes are cheaper than e-bikes, as the latter offers effortless driving, more convenience, and variable motor power, as well as higher speeds.

One of the most interesting investment deals in 2020 that underlines the interest in e-bikes involved London-based free-to-use shared electric bike firm London-based HumanForest. It announced in September that it had raised £1.8 million. HumanForest offers 20 minutes free per day and a corporate subscription service. It launched in June 2020. In just four months of the company’s operations, 14,000 riders have taken almost 42,000 rides with the number of rides increasing by over 100% month on month!

Later that year, the company raised £1.27m via crowdfunding with the support of over 520 investors, of whom approximately 30% were trial users. The company says that it ran a successful trial during summer 2020 in London with 200 e-bikes. The new funds will be used to expand the fleet to 1,500 e-bikes.

HumanForest’s business model is based on three sources of revenue - users pay 15p per minute after their free daily 10-minute ride is up, while partner companies pay to advertise their brand on the HumanForest digital platform and companies pay to offer their employees further minutes for the HumanForest fleet.

Bike-sharing - more positive than negative aspects

If we analyze positive, as well as negative aspects that could influence the future of bike-sharing, the positive aspects far exceed the negative ones. The only negative aspects are high initial investment costs, as well as the rise in bike vandalism and theft. Positive aspects that could stimulate the bike-sharing business in the future are growing venture capital investments, an increase in the inclusion of e-bikes in the sharing fleet, as well as technological advances in bike-sharing systems.

There is also increased interest from governments in different initiatives for the development of bike-sharing infrastructure. Furthermore, governments are offering subsidies to service providers for developing stations and expanding their reach to a large number of commuters. For instance, in 2018, Chinese Municipal governments subsidized the Public Bike Sharing Program development to encourage non-motorized transport and offer convenient, flexible, and low-cost mobility options. Meanwhile, in Europe, the new public bike-sharing system was launched in the Italian Municipality of Trieste in February 2020. The system, known as BiTS, is being implemented as part of the city's Integrated Sustainable Urban Development Plan at a cost of EUR 390,000, with the aim of developing sustainable mobility by promoting walking and cycling to reduce urban pollution.

Despite the fact that interest in bike-sharing is rising and will continue to do so, it is equally important to learn and not forget the mistakes of pioneers of the industry. For example, the company Ofo was founded in 2014 as a university project, but soon afterward raised $866 million from investors led by Chinese e-commerce giant Alibaba. Ofo was a station-free bike-sharing platform operated via an online mobile application. In total, over the course of nine investment rounds, the company has raised USD 2.2 billion but has still consistently experienced cash flow problems that were driven largely by intense competition in a market that has yet to be proven to be commercially viable according to analysts interviewed by Forbes.

Fees dropped to 1 yuan ($0.14) for each hour of use and sometimes were even free. Despite this fact, Ofo still managed to reach a valuation of $2 billion in a 2017 funding round and around $3 billion at its highest point, and at one time the company deployed more than 10 million bikes globally and attracted as many as 200 million users. “The company’s cash-burning operations and high valuation have combined to deter potential investors, and when capital became scarce, the startup could no longer cover its once sprawling operations,” wrote Forbes.

In 2018, Ofo announced a massive reduction in operations, and by 2020 it faced a large amount of unpayable debt as a result of which the company was no longer operating bike rentals. “Explanations of what exactly went wrong are still evolving, but it seems likely that the mind-boggling amounts of cash pumped into what wasn't essentially a "bike-sharing" model, but rather a rental business pepped up by a smartphone app, had something to do with it. Yes, the company bought bikes and placed them in the streets without docks for anybody to use, and that was somewhat new. And yes, a smartphone app served as the key. But the company owned the bikes, just like any old-fashioned rental shop, and incurred huge maintenance costs,” explained analysts from Roland Berger Strategy Consultants, who were quoted in its magazine “Own the future”.

So it doesn't matter how big the demand for the service is, you should always apply simple business principles to your business.

Click below to learn more or request a demo.

The micromobility industry doesn’t need another generic mobility conference. 🚫🎤 It needs real conversations between operators who are actually in the field. ⚙️ That’s exactly what ATOM Connect 2026 is built for. 🎯🤝

The shared mobility industry is evolving rapidly. Operators are navigating scaling challenges, regulatory complexity, hardware decisions, fleet optimization, and new integration models, all while aiming for sustainable growth.

That’s exactly why ATOM Mobility is organizing ATOM Connect 2026.

Our previous edition of ATOM Connect brought together professionals from the car sharing and rental industry for focused, high-quality discussions and networking. This year, we are narrowing the focus and dedicating the entire event to one fast-moving segment of the industry: shared micromobility.

ATOM Connect 2026 is designed specifically for operators, partners, and decision-makers working in shared micromobility. It is not a broad mobility conference or a public exhibition. It is a curated space for industry professionals to exchange practical experience, insights, and lessons learned.

On May 14th, 2026 in Riga, we will once again bring the community together, this time with a clear focus on micromobility.

What to expect

This year’s agenda will address the real operational and strategic questions shaping shared micromobility today:

- Scaling fleets sustainably

- Multi-vehicle operations beyond scooters

- Regulatory cooperation and long-term city partnerships

- Data-driven fleet optimization

- MaaS integration and ecosystem collaboration

- Marketing and automation for growth

As usual, we aim to host both local and international operators from smaller, fast-growing fleets to established large-scale players alongside hardware providers and ecosystem partners.

On stage, you’ll hear from leading shared mobility companies - including Segway on hardware partnerships, Umob on MaaS integration, Anadue on data-driven fleet intelligence, Elerent on multi-vehicle operational realities and more insightful discussions.

The goal is simple: meaningful discussions with people who understand the operational realities of the industry.

A curated, industry-focused event

ATOM Connect is free to attend, but participation is industry-focused (each submission is manually reviewed and verified). We are intentionally keeping the audience relevant and aligned to ensure high-quality conversations and valuable networking.

If you work in shared micromobility and would like to join the event, you can find the full agenda and register here:

👉 https://www.atommobility.com/atom-connect-2026

In the coming weeks, we will be revealing more speakers and additional agenda updates. We look forward to bringing the industry together again.

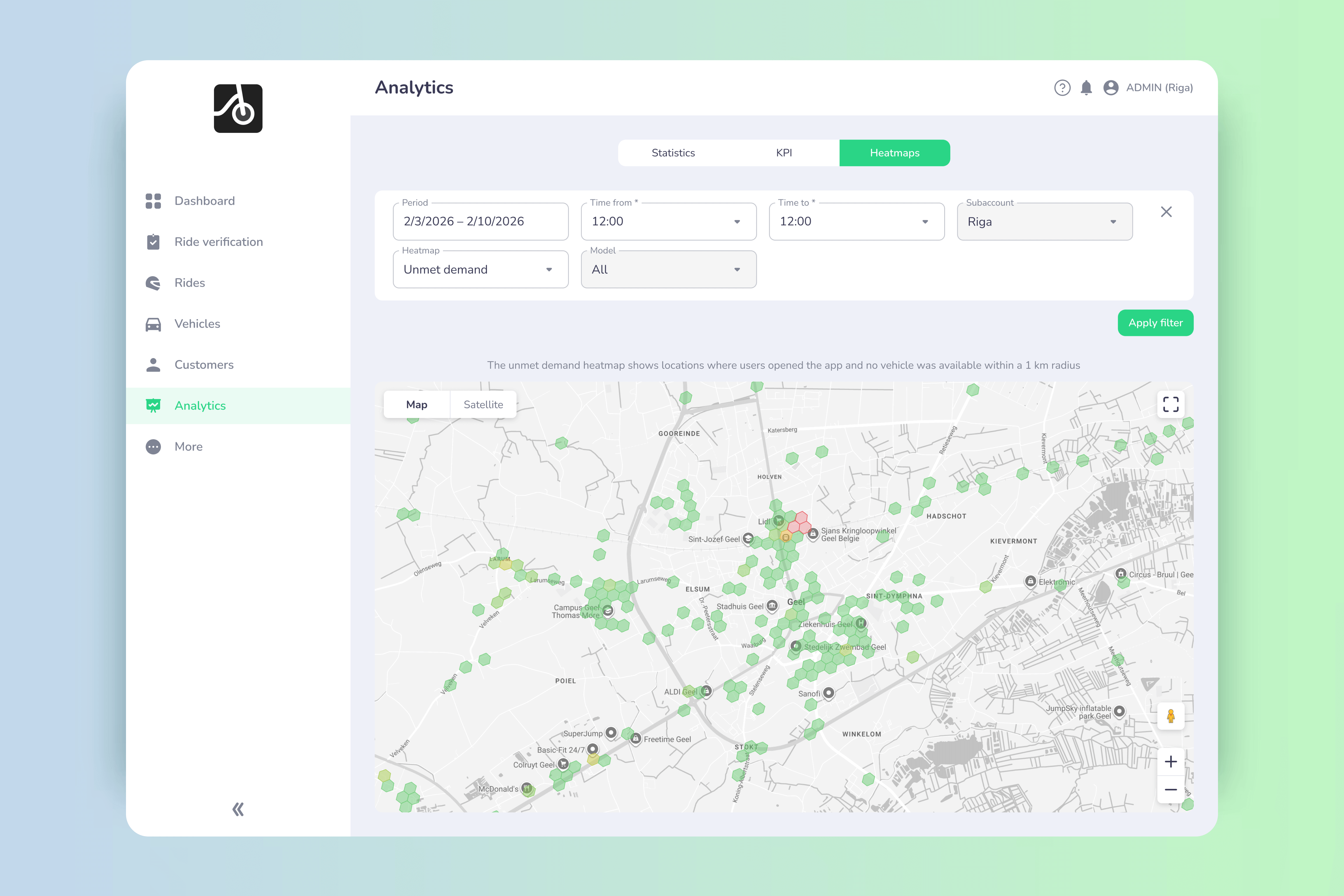

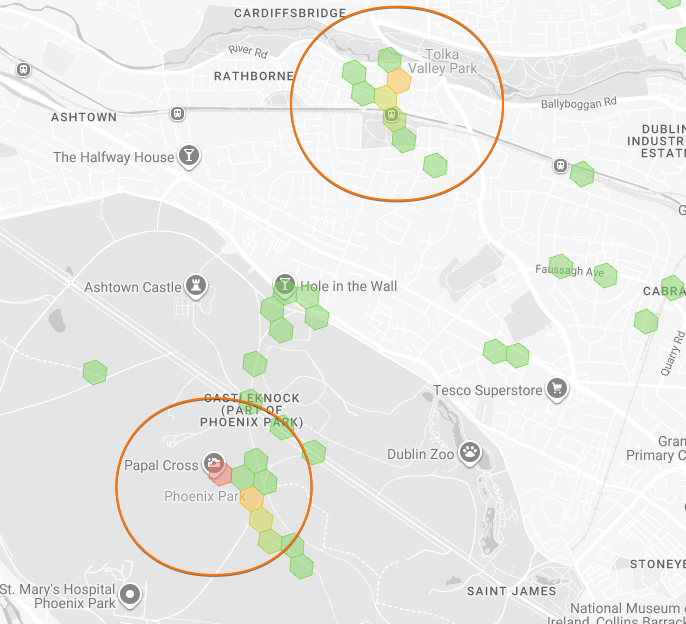

📉 Every unmet search is lost revenue. The unmet demand heatmap shows where users actively searched for vehicles but none were available - giving operators clear, search-based demand signals to rebalance fleets 🚚, improve conversions 📈, and grow smarter 🧠.

Fleet operators don’t lose revenue because of lack of demand - they lose it because demand appears in the wrong place at the wrong time. That’s exactly the problem the Unmet demand heatmap solves.

This new analytics layer from ATOM Mobility shows where users actively searched for vehicles but couldn’t find any within reach. Not guesses. Not assumptions. Real, proven demand currently left on the table.

What is the unmet demand heatmap?

The unmet demand heatmap highlights locations where:

- A user opened the app

- Actively searched for available vehicles

- No vehicle was found within the defined search radius

In other words: high-intent users who wanted to ride, but couldn’t. Unlike generic “app open” data, unmet demand is recorded only when a real vehicle search happens, making this one of the most actionable datasets for operators.

Why unmet demand is more valuable than app opens

Many analytics tools track where users open the app (ATOM Mobility provides this data too). That’s useful - but incomplete. Unmet demand answers a much stronger question:

Where did users try to ride and failed? That difference matters.

Unmet demand data is:

✅ Intent-driven (search-based, not passive)

✅ Directly tied to lost revenue

✅ Immediately actionable for rebalancing and expansion

✅ Credible for discussions with cities and partners

How it works

Here’s how the logic is implemented under the hood:

1. Search-based trigger. Unmet demand is recorded only when a user performs a vehicle search. No search = no data point.

2. Distance threshold. If no vehicle is available within 1,000 meters, unmet demand is logged.

- The radius can be customized per operator

- Adaptable for dense cities vs. suburban or rural areas

3. Shared + private fleet support. The feature tracks unmet demand for:

- Shared fleets

- Private / restricted fleets (e.g. corporate, residential, campus)

This gives operators a full picture across all use cases.

4. GPS validation. Data is collected only when:

- GPS is enabled

- Location data is successfully received

This ensures accuracy and avoids noise.

Smart data optimization (no inflated demand)

To prevent multiple searches from the same user artificially inflating demand, the system applies intelligent filtering:

- After a location is stored, a 30-minute cooldown is activated

- If the same user searches again within 30 minutes And within 100 meters of the previous location → the record is skipped

- After 30 minutes, a new record is stored - even if the location is unchanged

Result: clean, realistic demand signals, not spammy heatmaps.

Why this matters for operators

📈 Increase revenue

Unmet demand shows exactly where vehicles are missing allowing you to:

- Rebalance fleets faster

- Expand into proven demand zones

- Reduce failed searches and lost rides

🚚 Smarter rebalancing

Instead of guessing where to move vehicles, teams can prioritize:

- High-intent demand hotspots

- Time-based demand patterns

- Areas with repeated unmet searches

🏙 Stronger city conversations

Unmet demand heatmaps are powerful evidence for:

- Permit negotiations

- Zone expansions

- Infrastructure requests

- Data-backed urban planning discussions

📊 Higher conversion rates

Placing vehicles where users actually search improves:

- Search → ride conversion

- User satisfaction

- Retention over time

Built for real operational use

The new unmet demand heatmap is designed to work alongside other analytics layers, including:

- Popular routes heatmap

- Open app heatmap

- Start & end locations heatmap

Operators can also:

- Toggle zone visibility across heatmaps

- Adjust time periods (performance-optimized)

- Combine insights for strategic fleet planning

From missed demand to competitive advantage

Every unmet search is a signal. Every signal is a potential ride. Every ride is revenue. With the unmet demand heatmap, operators stop guessing and start placing vehicles exactly where demand already exists.

👉 If you want to see how unmet demand can unlock growth for your fleet, book a demo with ATOM Mobility and explore how advanced heatmaps turn data into decisions.