Drumroll, please!

ATOM Mobility has taken user engagement to the next level with a new loyalty module.

Users can now take part in exciting challenges and earn rewards upon completion. ATOM Mobility's integration of gamification into its platform aims to enhance the overall user experience – and offers a unique opportunity for operators to differentiate themselves from the competition.

Let's take a closer look at the opportunities and benefits of this new loyalty module.

The benefits of gamification

Gamification is a way of makings apps more fun and engaging by adding game-like elements. The idea is to give users a sense of accomplishment as they progress and complete tasks.

Popular examples of gamification in apps include:

- Duolingo: This language learning app incorporates gamified elements such as levels, achievements, and a point system to make the learning process more enjoyable and engaging.

- Fitbit: The app tracks users' physical activities and fitness goals while employing gamification elements like challenges, badges, and leaderboards to motivate users and create a sense of competition.

- Headspace: This meditation app incorporates gamification through features like streak tracking and milestones, motivating users to establish a consistent meditation practice by providing rewards and a sense of accomplishment as they progress.

These apps offer solid proof that gamification strikes a chord with users. And now ATOM Mobility has taken the lead by introducing gamification to the white-label shared mobility industry for the first time. Why is it a big deal?

Here are just a few benefits that gamification offers to your shared mobility business:

- Enhanced user engagement: By introducing challenges, rewards, and interactive elements, users are motivated to actively participate in the app's offerings. The element of challenge and the desire to achieve milestones keeps users hooked and encourages them to explore other app features. This translates into increased usage of your app.

- Improved user retention: Challenges, levels, and rewards foster a sense of progression and keep users coming back for more. The element of surprise and the anticipation of unlocking new features or rewards incentivize users to remain loyal to the app over time.

- Data insights: Gamification allows operators to collect valuable data and insights into user behavior. By tracking user engagement, progress, and preferences within the game-like features, operators can get to know their customers better. This information can be used to personalize the user experience, creating challenges and rewards that cater to individual user preferences – thus encouraging even higher levels of engagement.

Drive user engagement with challenges

In order to activate the module, operators can contact their account manager at ATOM Mobility.

Once the loyalty module is enabled, operators gain access to a dashboard where they can create and configure a variety of challenges. Each challenge can be personalized with a title, a specific points-based goal, a duration, and an enticing reward upon completion – such as a discount for the next few rides.

Operators can spice up the shared mobility platform by crafting multi-level challenges with step numbers. These steps set the sequence in which challenges appear, meaning users have to finish one step before unlocking the next challenge. This way, operators can inject some fun into the shared mobility experience – and keep users on their toes.

Customization and data insights

Operators can customize the loyalty module according to their preferences, for example:

- Choose how many points users get for each ride

- Adjust the point calculation logic, e.g., you can exclude short rides (under 5 minutes) to prevent users from taking advantage of the system (contact the support team to do it!)

- The length of challenges and whether they have multiple levels

When a user completes a challenge, the system notifies them of their achievement, and the user automatically receives the reward. If a challenge expires without the user earning the required points, the system resets the challenge, and the user can try again.

In the meantime, here's what data is available to operators:

- User participation in specific challenges – see the total number of users who joined a particular challenge, the number of successful completions, and the number of participants still working on it.

- Progress of each participant – this helps operators evaluate the module's effectiveness in engaging users and decide if any adjustments are needed to improve its performance.

Stand out from the competition with ATOM Mobility

The loyalty module presents an opportunity for shared mobility operators to distinguish themselves from industry giants by enhancing the "stickiness" of their solution. By integrating the loyalty module into their platform, operators can offer users incentives to stay connected – fostering a sense of loyalty and long-term engagement.

Atom Mobility clients are already enjoying the advantages of the new module. As per Milad, the founder of Qick, "The setup process for the Loyalty model is simple and effortless, resulting in heightened customer engagement and increased rides. It serves as an excellent means to involve users in the brand."

The loyalty module introduces another dimension to the highly customizable white-label ATOM Mobility platform – with an added touch of fun.

Click below to learn more or request a demo.

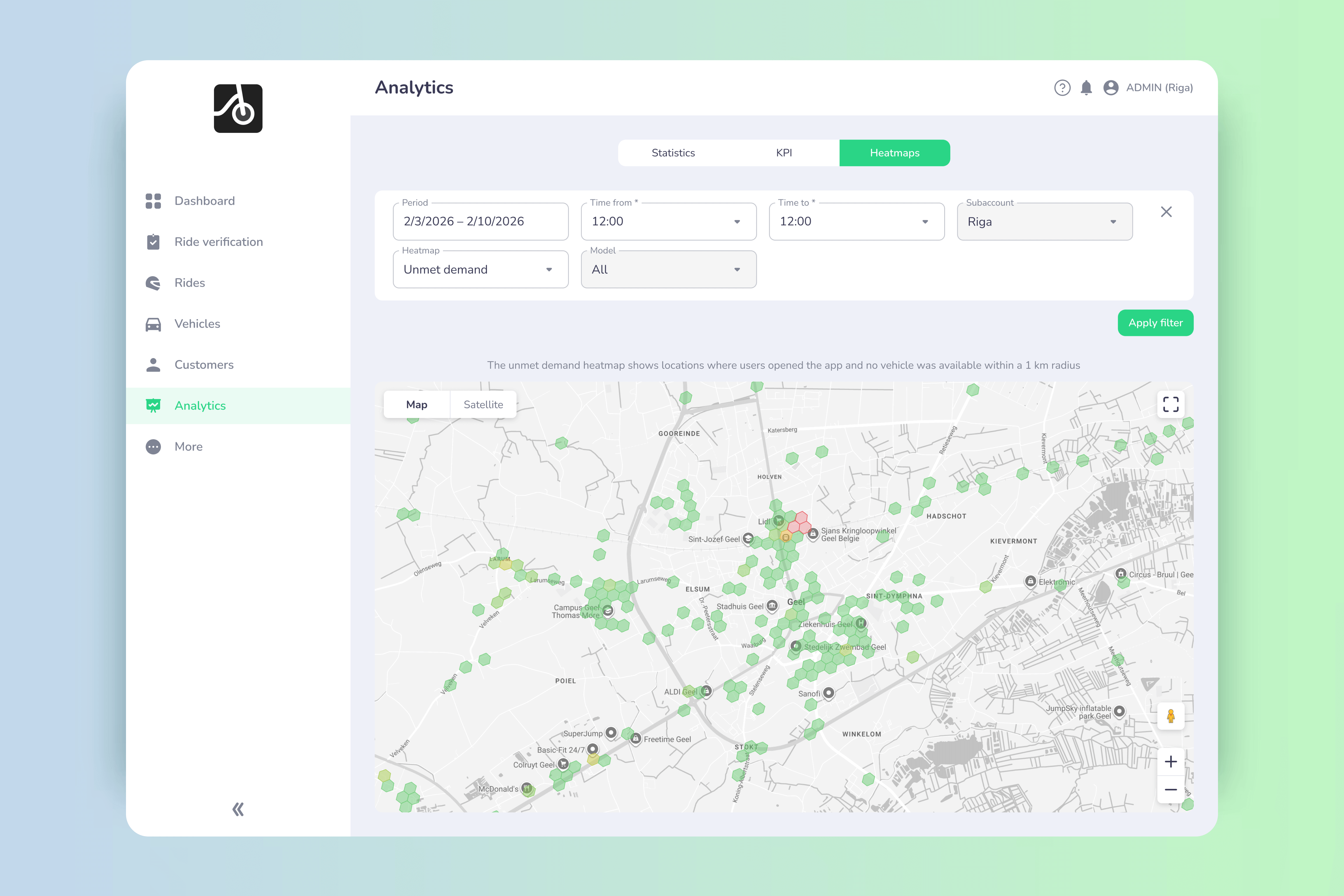

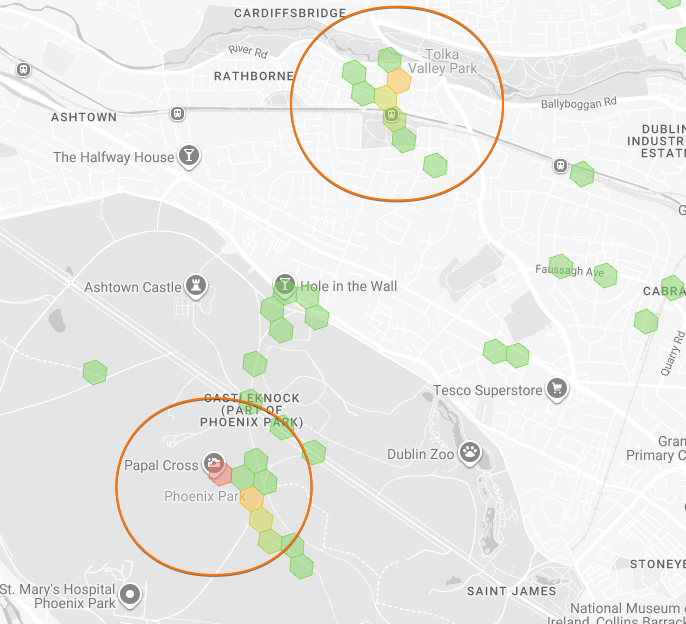

📉 Every unmet search is lost revenue. The unmet demand heatmap shows where users actively searched for vehicles but none were available - giving operators clear, search-based demand signals to rebalance fleets 🚚, improve conversions 📈, and grow smarter 🧠.

Fleet operators don’t lose revenue because of lack of demand - they lose it because demand appears in the wrong place at the wrong time. That’s exactly the problem the Unmet demand heatmap solves.

This new analytics layer from ATOM Mobility shows where users actively searched for vehicles but couldn’t find any within reach. Not guesses. Not assumptions. Real, proven demand currently left on the table.

What is the unmet demand heatmap?

The unmet demand heatmap highlights locations where:

- A user opened the app

- Actively searched for available vehicles

- No vehicle was found within the defined search radius

In other words: high-intent users who wanted to ride, but couldn’t. Unlike generic “app open” data, unmet demand is recorded only when a real vehicle search happens, making this one of the most actionable datasets for operators.

Why unmet demand is more valuable than app opens

Many analytics tools track where users open the app (ATOM Mobility provides this data too). That’s useful - but incomplete. Unmet demand answers a much stronger question:

Where did users try to ride and failed? That difference matters.

Unmet demand data is:

✅ Intent-driven (search-based, not passive)

✅ Directly tied to lost revenue

✅ Immediately actionable for rebalancing and expansion

✅ Credible for discussions with cities and partners

How it works

Here’s how the logic is implemented under the hood:

1. Search-based trigger. Unmet demand is recorded only when a user performs a vehicle search. No search = no data point.

2. Distance threshold. If no vehicle is available within 1,000 meters, unmet demand is logged.

- The radius can be customized per operator

- Adaptable for dense cities vs. suburban or rural areas

3. Shared + private fleet support. The feature tracks unmet demand for:

- Shared fleets

- Private / restricted fleets (e.g. corporate, residential, campus)

This gives operators a full picture across all use cases.

4. GPS validation. Data is collected only when:

- GPS is enabled

- Location data is successfully received

This ensures accuracy and avoids noise.

Smart data optimization (no inflated demand)

To prevent multiple searches from the same user artificially inflating demand, the system applies intelligent filtering:

- After a location is stored, a 30-minute cooldown is activated

- If the same user searches again within 30 minutes And within 100 meters of the previous location → the record is skipped

- After 30 minutes, a new record is stored - even if the location is unchanged

Result: clean, realistic demand signals, not spammy heatmaps.

Why this matters for operators

📈 Increase revenue

Unmet demand shows exactly where vehicles are missing allowing you to:

- Rebalance fleets faster

- Expand into proven demand zones

- Reduce failed searches and lost rides

🚚 Smarter rebalancing

Instead of guessing where to move vehicles, teams can prioritize:

- High-intent demand hotspots

- Time-based demand patterns

- Areas with repeated unmet searches

🏙 Stronger city conversations

Unmet demand heatmaps are powerful evidence for:

- Permit negotiations

- Zone expansions

- Infrastructure requests

- Data-backed urban planning discussions

📊 Higher conversion rates

Placing vehicles where users actually search improves:

- Search → ride conversion

- User satisfaction

- Retention over time

Built for real operational use

The new unmet demand heatmap is designed to work alongside other analytics layers, including:

- Popular routes heatmap

- Open app heatmap

- Start & end locations heatmap

Operators can also:

- Toggle zone visibility across heatmaps

- Adjust time periods (performance-optimized)

- Combine insights for strategic fleet planning

From missed demand to competitive advantage

Every unmet search is a signal. Every signal is a potential ride. Every ride is revenue. With the unmet demand heatmap, operators stop guessing and start placing vehicles exactly where demand already exists.

👉 If you want to see how unmet demand can unlock growth for your fleet, book a demo with ATOM Mobility and explore how advanced heatmaps turn data into decisions.

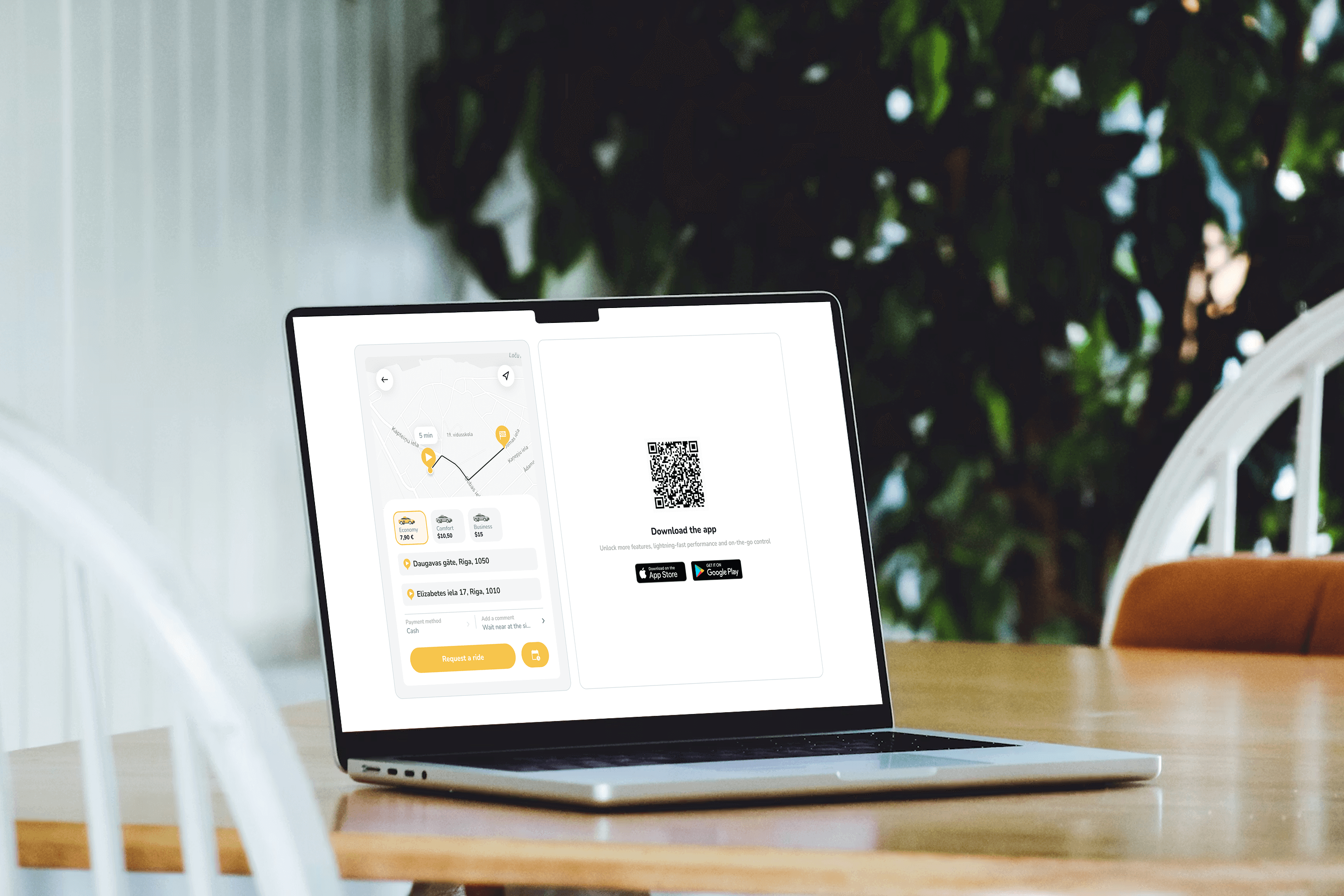

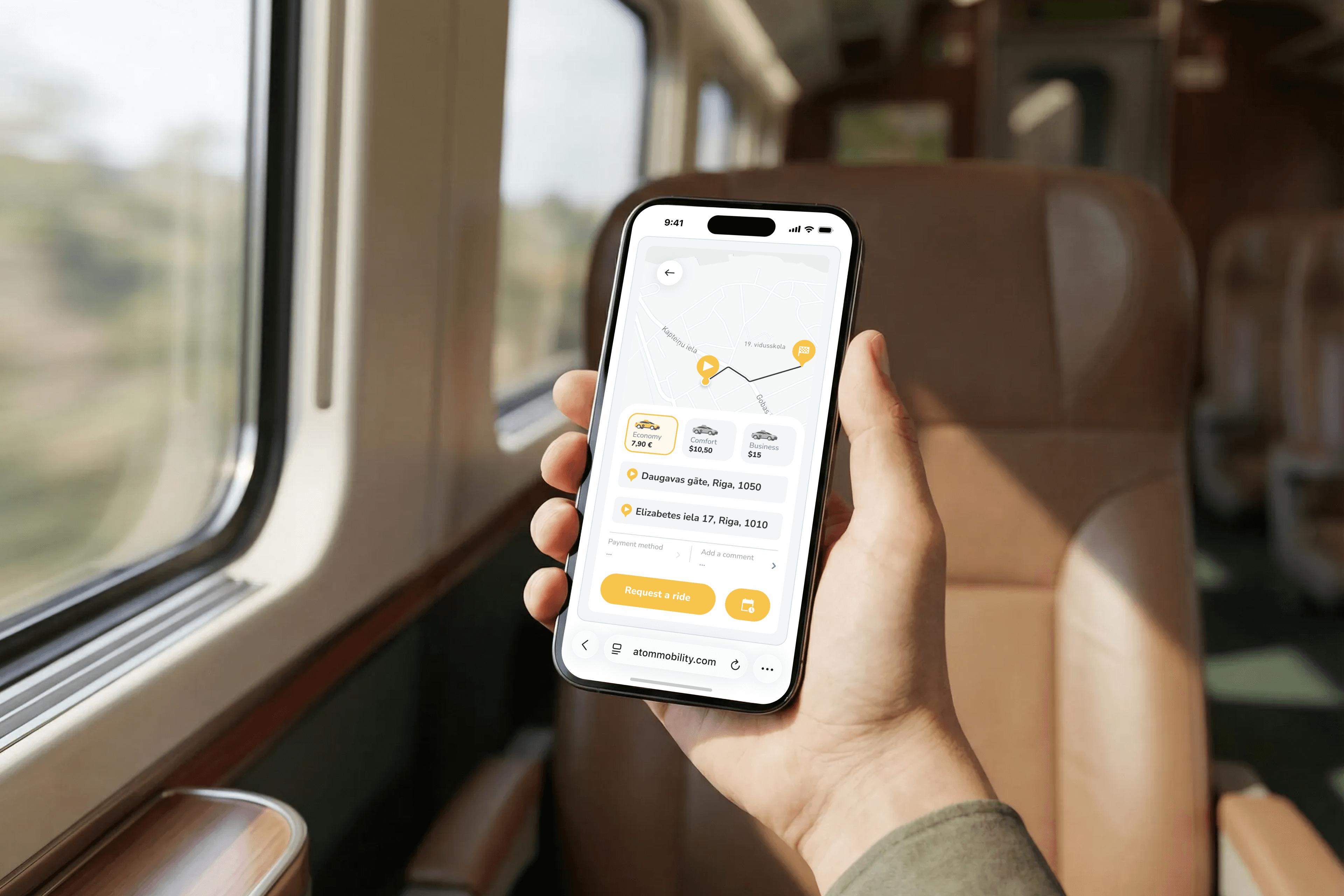

🚕 Web-booker is a lightweight ride-hail widget that lets users book rides directly from a website or mobile browser - no app install required. It reduces booking friction, supports hotel and partner demand, and keeps every ride fully synced with the taxi operator’s app and dashboard.

What if ordering a taxi was as easy as booking a room or clicking “Reserve table” on a website?

Meet Web-booker - a lightweight ride-hail booking widget that lets users request a cab directly from a website, without installing or opening the mobile app.

Perfect for hotels, business centers, event venues, airports, and corporate partners.

👉 Live demo: https://app.atommobility.com/taxi-widget

What is Web-booker?

Web-booker is a browser-based ride-hail widget that operators can embed or link to from any website.

The booking happens on the web, but the ride is fully synchronized with the mobile app and operator dashboard.

How it works (simple by design)

No redirects. No app-store friction. No lost users.

- Client places a button or link on their website

- Clicking it opens a new window with the ride-hail widget

- The widget is branded, localized, and connected directly to the operator’s system

- Booking instantly appears in the dashboard and mobile app

Key capabilities operators care about

🎨 Branded & consistent

- Widget color automatically matches the client’s app branding

- Feels like a natural extension of the operator’s ecosystem

- Fully responsive and optimized for mobile browsers, so users can book a ride directly from their phone without installing the app

📱 App growth built in

- QR code and App Store / Google Play links shown directly in the widget

- Smooth upgrade path from web → app

⏱️ Booking flexibility

- Users can request a ride immediately or schedule a ride for a future date and time

- Works the same way across web, mobile browser, and app

- Scheduled bookings are fully synchronized with the operator dashboard and mobile app

🔄 Fully synced ecosystem

- Country code auto-selected based on user location

- Book via web → see the ride in the app (same user credentials)

- Dashboard receives booking data instantly

- Every booking is tagged with Source:

- App

- Web (dashboard bookings)

- Booker (website widget)

- API

🔐 Clean & secure session handling

- User is logged out automatically when leaving the page

- No persistent browser sessions

💵 Payments logic

- New users: cash only

- Existing users: can choose saved payment methods

- If cash is not enabled → clear message prompts booking via the app

This keeps fraud low while preserving conversion.

✅ Default rollout

- Enabled by default for all ride-hail merchants

- No extra setup required

- Operators decide where and how to use it (hotel partners, landing pages, QR posters, etc.)

Why this matters in practice

Web-booker addresses one of the most common friction points in ride-hailing: users who need a ride now but are not willing to download an app first. By allowing bookings directly from a website, operators can capture high-intent demand at the exact moment it occurs - whether that is on a hotel website, an event page, or a partner landing page.

At the same time, Web-booker makes partnerships with hotels and venues significantly easier. Instead of complex integrations or manual ordering flows, partners can simply place a button or link and immediately enable ride ordering for their guests. Importantly, this approach does not block long-term app growth. The booking flow still promotes the mobile app through QR codes and store links, allowing operators to convert web users into app users over time - without forcing the install upfront.

Web-booker is not designed to replace the mobile app. It extends the acquisition funnel by adding a low-friction entry point, while keeping all bookings fully synchronized with the operator’s app and dashboard.

👉 Try the demo

https://app.atommobility.com/taxi-widget

Want to explore a ride-hail or taxi solution for your business - or migrate to a more flexible platform? Visit: https://www.atommobility.com/products/ride-hailing